How much do you need in retirement savings?

What should you start saving today?

How do you calculate how much you need and how much to save?

The bottom line: YOU Must Create Retirement Savings.

And, if you’re planning on relying on your monthly Social Security checks to get you by in retirement, you might want to rethink your plan.

According to the latest studies, the median retirement savings for American adults is $65,000 for all adults in America. In addition, another report shows that 1 in 4 Americans don’t have anything saved for retirement.

Of course Social Security will help out a little, but it definitely won’t fund the lifestyle most people are used to prior to retirement. In fact, the average monthly Social Security check in 2021 was only $1,658 per month.

What is Life in Retirement Like for Those Who Didn’t Create Retirement Savings?

What does life hold for those who haven’t saved enough for retirement?

Chris Hogan was a guest on the Money Peach Podcast and shares the heart-wrenching story of Michael; a young man visiting his sweet aunt only to discover she had been (literally) living on dog food as that was all she could afford to eat.

The story brought a catalyst of change for Michael and his wife, partly because they had a financial picture themselves which included little savings, massive debt, and no cash reserves to help out Michael’s beloved aunt.

Another story is of Jean.

Jean worked her entire life as a cashier at a grocery store. The grocery store did offer a 401k retirement plan with a match, however she never took advantage of contributing to her own retirement.

When it came to retire, Jean soon realized her social security check would only be $1,100 per month, thus putting her right at the poverty line according the Federal Government.

At nearly 80 years old, Jean is going to work an additional 3 days per week to make ends meet. Remember, she went back to work not because she wants to, but because she has to.

How Much Do You Need in Retirement?

Don’t wait until you are in a position like Jean or like Michael’s aunt to start worrying about your level of retirement savings. As you can see, it’s extremely important to start taking the necessary steps to increase retirement savings NOW – while you still have the physical and mental capabilities to do so.

But how much do you I actually need in retirement?

This answer is different for everyone and it all depends on one thing: the number (dollar amount) you will need in retirement.

To start, ask yourself how much you need to have saved when you start your retirement. To help determine how much you will need, ask yourself the following:

- Will I have any debt left in retirement?

- Will I still have a mortgage?

- What about child expenses, if any?

- What will I do with the time originally spent working and how much will that cost?

It doesn’t have to be perfect, but come up with a dollar amount you will need each year in retirement.

The 4% Rule

A quick way to determine how much you will need to have saved in retirement is to use the 4% rule.

Now, this isn’t a hard-and-fast rule but it’s a great starting point to determine roughly how much you will need at retirement. The 4% rule states that if you only draw 4% of your nest egg per year, not only will your nest egg last you throughout your entire retirement, but the value of your nest egg will remain the same (on average) throughout your entire retirement.

To calculate, simply determine the annual income you would need in retirement and then divide it by 0.04.

Example: If you want to retire with an annual income of $80,000, then you would need a $2 million nest egg in retirment using the 4% rule. If you think you need $120,000 per year, then you will need to build a $3 million nest egg.

How Much Do You Need to Start Saving?

Now that you know how much you need in retirement, let’s next determine how much you need to start saving each month. Of course there is no crystal ball that will guarantee your future nest egg amount, however you do have something you can lean on — the past performance of the stock market and retirement funds.

Going back and looking at the stock market (the S&P 500) from 1957 to 2021, the average return was 10.67%. Of course this doesn’t mean you are guaranteed a 10.67% return for your future investing, but it gives you a good starting point.

With the historical performance of 10.67%, use a range for your future savings. Maybe that range looks something like 8% – 12%, as your annual return inside an investment calculator.

This will also show you how much you will need to save each month depending on your age and the annual return you are using.

Let’s take a quick look at an example:

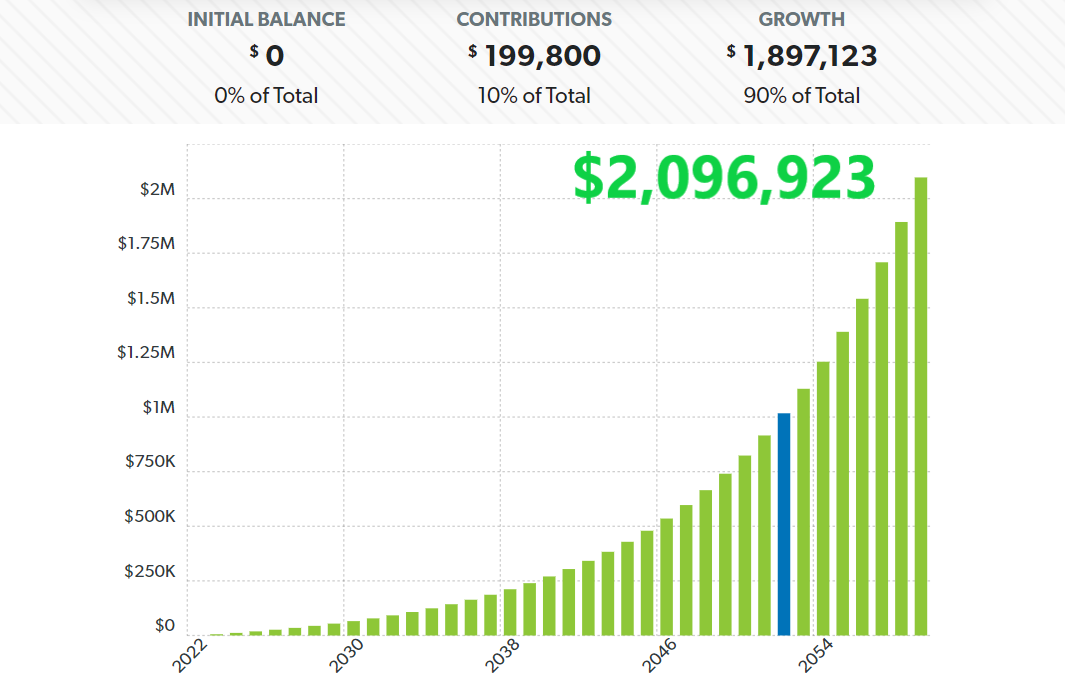

- Age: 30

- How much currently saved: $0

- How much invested per month: $450

- How long to invest: 37 years (age 67)

- Annual return on investment: 10%

- Estimated Retirement Savings: $2,096,923

Let’s look at another example:

- Age: 45

- How much currently saved: $65,000

- How much invested per month: $550

- How long to invest: 25 years (age 70)

- Annual return on investment: 8%

- Estimated Retirement Savings: $1,000,175

Allocate Retirement Savings from Your Monthly Budget

If you haven’t already done so, it’s time to create a budget — AKA a cash-flow plan.

A cash flow plans allows you to identify exactly what you need to save each month and where you will be saving from in order to reach your retirement goals.

Saving enough for a healthy retirement may require a few tough decisions, but I promise they will not kill you.

For example, you may be have to cancel your cable TV subscription, downgrade the type of car you drive, avoid spending too much time inside restaurants, or you may even want to pick up a montly side hustle.

When Chris and his wife paid off $52,000 in consumer debt in just seven months they had to make some of those tough decisions. They sold everything (including both of their newer cars), picked up extra jobs, and lived on “scorched earth lifestyle” to regain control of their life and money.

Today they are now on the path of building substantial wealth and they will both tell you their short term sacrifice was worth the long term gain.

Where Do I Invest?

Here is the order I recommend when it comes to investing for retirement using tax-favored retirement accounts.

1. Employer Sponsored Plan

Did you know that 67% of current employers offer a 401k plan? In addition to offering a retirement savings plan, employers on average will match between 3% and 8% into your 401k on your behalf. This is truly FREE money!

Start off by contributing up to the maximum match your employer will allow. For example, if you’re employer matches up to 4% if you contribue 8%, then contribute 8%.

Note: Other options beyond a 401k are a 403b, 457, TSP, and a ROTH option for each.

2. ROTH IRA

Once you’ve taken advantage of the free match from your employer, next is to contribute to your ROTH IRA. To jog your memory, a ROTH IRA is invested with after-tax dollars, therefore giving a tax-free withdrawals in retirement. In 2022, you can contribue up to $6,000 into your ROTH IRA and then an additional $1,000 per year if you are over age 50.

I have both a ROTH IRA and a Traditional IRA at M1 Finance — M1 Finance has expert portfolios for you to choose from based on your risk level. Also, with the price of single stocks often costing over $1,000, M1 Finance allows you to invest in partial stocks so you can still get started investing no matter how much you are starting with.

3. Go Back to Employer Sponsored Plan

The maximum contribution limits to your 401k (or the like) in 2022 is $20,500 and then an additional $6,500 if you’re over age 50. After you have taken advantage of the free match from your employer and then maxed out your ROTH IRA, any additional money you have to invest can go towarsd maxing out your 401k.

Retirement Funding Example

Let’s assume you need to contribute $18,000 per year ($1,500 per month) in order to meet your retirement goals. If your current income is $100,000 per year, this is the breakdown of your investing:

- $8,000 into 401k (to get the 4% match)

- $6,000 into ROTH IRA

- $4,000 more back into 401k

Retirement Isn’t an Age, it’s a Number

The best time to start saving for retirement is today. In fact, it’s never too late to start but — the earlier you get started, the easier it is.

Whether you’re someone who is nearing retirement or you have 40 years left to work, start saving for retirment today!

Lastly, unless you are fortunate to have a pension, retirement for you is not an age, it’s a number. Ask yourself these three questions:

- How much will you need in retirement?

- How much do you need to have saved at retirement using the 4% rule?

- How much do you need to start saving right now?

Now that you know what to do, it’s time to get started.