2020 Fundrise Review

Name: Fundrise

Description: Fundrise allows everyday investors the ability to diversify their portfolio by investing in private market real estate. People who choose to invest with Fundrise, invest directly in hotels, apartment buildings, commercial real estate, and even single family homes. Since the company started in 2010, they have grown to over 500,000 investors and $2.5 billion in real estate investments with an average 5-year return of 8.42%.

Overall

-

Minimum Investment

-

Investment Options

-

Liquidity

-

Customer Satisfaction

-

Fees

-

Historical Performance

Summary

Overall summary of investing with Fundrise.

Pros

- $500 min investment

- Open to all investors

- Different plans to choose from

- Low minimum investment

- IRA Accounts available

- 90-day money-back guarantee

- High ratings from current users

Cons

- Illiquidity: Can’t easily sell assets. Must wait five years to avoid the early redemption fee.

- Expensive IRA Option: You must pay a $125 annual fee to the third party IRA custodian

Investing into private real estate via platforms like Fundrise is now an extremely popular way to earn reliable passive income.

Until a few years ago, the only option for most people was buying rental property, flipping houses, or requiring large upfront capital to gain access to a private investment deal. All of these require large amounts of time, focus and money.

However, with the use of technology and deregulation of the government and real estate, there is now an option for everyone to become a real estate investor.

This sector used to only be available to the wealthy. Now, you can invest in private real estate deals and earn potentially more than regular stock investments.

If you want to gain exposure to a new real estate sector, and you can invest $500 for at least five years, Fundrise can be the answer you’re looking for.

Contents For This Post (Click to Open)

Fundrise Review 2020

Fundrise is a real estate investment platform that services over 500,000 investors and manages $2.5 billion in real estate investments. They also have a A+ rating with the BBB.

Fundrise is a real estate investment platform that services over 500,000 investors and manages $2.5 billion in real estate investments. They also have a A+ rating with the BBB.

If you don’t remember, 2012 was a big year for private real estate investing. In this year, the JOBS Act opened the doors for regular non-accredited investors (i.e. non-millionaires) to invest in private real estate deals.

With Fundrise, you’re somewhere in between being a commercial real estate landlord and investing in real estate stocks. Instead of investing in companies that own apartments, office buildings and shopping centers, you directly invest in these properties.

In short, you are cutting out out the middle man and you are the bank.

Since you’re directly investing in real estate projects, you actually get paid before public investors. And, you can earn more because you’re assuming more risk.

With public real estate investing, the tenants pay the bank their monthly payment. After the company or real estate investment trust pays their bills, you (the investor) gets the remaining profit as a dividend.

The biggest difference with private equity real estate investing (Fundrise) is the profit/dividend goes directly to the investor. And, up until just a few years ago, the up front capital to get started was significant — upwards of $50,000 to get started and additional follow-up investments over time.

However, Fundrise allows investors access to private real estate starting at $500 to open an account.

Advantages of Private Real Estate Investing

Since you’re a “stakeholder” instead of a “shareholder,” your investment can earn more dividends and equity appreciation than investing in public real estate.

More importantly, stock market dips don’t affect private real estate returns to the same extent as public real estate investment returns. Private real estate has its own set of risks, but you can expect monthly dividend payments each quarter.

Tax Advantages

Investing in private real estate through Fundrise should also consider an investment period of five ore more years. The reasoning has to do with the length of time you own the asset and how you will be taxed.

Short-Term Capital Gains

If you the investor only decided to invest for one year or less, your private real estate earnings are considered short-term capital gains and are taxed as ordinary income. This means they are taxed at your regular (higher) tax bracket. For example, if you held onto a Fundrise investment for one year or less and earned $1,000, you would be taxed just as if you were given a $1,000 raise with your employer.

Long-Term Capital Gains

However, if you were to invest and hold the investment for over one year, you would get a tax break through long-term capital gains tax and would be taxed at a lower rate than short-term gains. You the investor would then be subject to a tax rate of either 0%, 15% or 20%, depending on your tax bracket and filing status. Whichever long-term capital gains tax rates you fall into, they are still lower than your income tax bracket which means you save a lot of money come tax season.

IRA Option with Fundrise

You can also invest with Fundrise inside an IRA and take advantage of increased tax savings. Fundrise now offers IRA investments via a third party IRA custodian. There is an additional $125 annual account fee associated with opening an IRA and investing with Fundrise.

Disadvantage of Private Real Estate

There is one main disadvantage to investing in private real estate.

Your Funds Are Not Liquid

With Fundrise, you need to invest for the long haul. One of the reasons you can earn more with private real estate versus public real estate is the long-term investing horizon. If you want to sell your investment, it takes 60 – 90 days to get your money out. Also, there is a tiered penalty of 1% – 3% for withdrawing your funds from Fundrise before the five year mark. This is because Fundrise has to find another investor.

If you’ve ever tried selling a house, you know how long the closing process takes. Investing in private real estate is very similar.

Who Can Join Fundrise?

Any U.S. resident at least 18 years old can join Fundrise and it’s open to accredited and non-accredited investors.

Definition: The term “Accredited Investor” states you make at least $200k ($300k if married) a year and/or you have a $1 million net worth.

The year 2012 was very important for private real estate investing. In this year, the federal JOBS Act opened the doors for regular non-accredited investors to invest in these same deals.

Most private real estate investing sites only allow accredited investors, which is what makes Fundrise so unique at a startup investment of $500.

Who is Fundrise Best For?

Perhaps the more important question to ask is if you can benefit from investing in Fundrise.

Although there are many similarities, Fundrise is different than investing in real estate stocks and ETFs on Betterment or with your favorite investing app.

You should only invest money with Fundrise that you don’t need for at least five years. This is because of the 1% – 3% penalty for early withdrawal of your funds from Fundrise. In addition to the penalty, you can expect 60-90 days from the time you decide to sell your share of the investment and see the funds in your bank account.

The one exception is during the first 90 days — Fundrise offers a 90-day satisfaction guarantee.

By nature, private real estate investing in highly illiquid.

Definition: “Iliquid” means your money cannot be easily converted back into cash.

You cannot decide to sell your investment today and instantly get paid. As a reward for your commitment, you are more than likely to earn more passive income than other investments.

This illiquidity is why Fundrise and crowdfunded real estate shouldn’t be your only investment. Most of your investments should still be in liquid assets like stocks, bonds, and higher earned-interest bank accounts. With these three options, you have immediate access to cash if you need it.

Fundrise vs. Owning Rental Property

Maybe you’re already in a position to own rental property outright. But, you might also like Fundrise as an alternative way to invest in private commercial property. And, you can also own out-of-state rental property as well. This allows you to focus your efforts on local real estate and leave the rest to Fundrise.

Owning rental property can produce better results than Fundrise since you own the entire property. However, you know that rental properties require “sweat equity.” You also need to determine how valuable your time is.

If Fundrise can offer slightly less returns with minimal effort required, it can be a better option.

How Much Money Can You Earn on Fundrise?

Before you think you’re going to become the next millionaire real estate mogul, let’s clear the air:

- Fundrise is a great alternative to owning rental property

- It’s also a good alternative to only owning stocks, bonds, and a savings account

- Crowdfunded real estate doesn’t replace investing in stocks and bonds

Investing in private real estate is another way to earn passive income. It’s a good way to hedge against stock market volatility. And, you can gain exposure to another investing sector. But, its returns are similar to the broad stock market.

Most Fundrise investing plans have a projected return between 8.7% and 12.4% per year. This is slightly higher than the historic 7% annual return of the S&P 500, but you won’t become wealthy overnight.

In other words, don’t head to the Ferrari dealership yet.

Two Ways to Earn Income on Fundrise

Your investments earn passive income in two ways:

- Loan interest and tenant rent payments

- Appreciation of investment property values

You can either reinvest your dividends to earn more money. Or, Fundrise can distribute them to your bank account. To earn compound interest, you need to reinvest the dividends.

Loan interest and rent payments provide consistent monthly payments. Also, having the ability to sell properties at a profit helps Fundrise outperform the broad stock market.

Fundrise vs. Public REITs

For non-accredited investors, your two investing options are Fundrise eREITs and Public REITs.

Definition: “REIT” stands for Real Estate Investment Trust which is simply a company that owns, operates or finances income-producing real estate.

Both options invest in a basket of real estate properties. The largest difference between both options is that Fundrise invests in private real estate, and public REITs invest in companies that manage properties.

It’s not quite an apples-to-apples comparison because Fundrise eREITs invest in different assets than public REITs.

The U.S. REIT index includes residential and commercial properties. But, there are a few other property types that Fundrise doesn’t invest in like self-storage complexes.

Fundrise Historical Performance

According to Fundrise, this is the average annual return for the whole portfolio:

- 2019: 9.47%

- 2018: 9.11%

- 2017: 11.44%

- 2016: 8.76%

- 2015: 12.42%

For these five years, your average annual return is 10.24% with Fundrise.

These annualized returns are net of fees and assume you reinvest dividends. Fundrise bases these numbers on the dividend income and property appreciation.

There are several eREITS to choose from, so you might not earn 10% every year. Plus, fund performance changes each year as market conditions change.

Never assume any investment will earn a profit each year.

Public REIT Historical Performance

To be fair, the public US REIT index had an average return of 7.49% for the same time period. That’s is definitely lower than with Fundrise, however the last year the public eREIT did much better than the Fundrise private eREIT.

You will notice much more volatility in the returns:

- 2019: 25.84%

- 2018: – 4.57%

- 2017: 5.07%

- 2016: 8.60%

- 2015: 2.52%

Past performance doesn’t predict future results for any investment. From 2015, it doesn’t look like you “lose” money with Fundrise. If you missed the 2019 U.S. REIT boom, your Fundrise returns can be notably higher.

Fundrise vs Public REITs in 2015 – 2019

Below you will see overall Fundrise has definitely outperformed the REIT sector.

| Fundrise vs REIT Annual Returns | ||

|---|---|---|

| Fundrise | REIT | |

| 2019 | 9.47% | 25.84% |

| 2018 | 9.11% | -4.57% |

| 2017 | 11.44% | 5.07% |

| 2016 | 8.76% | 8.60% |

| 2015 | 12.42% | 2.52% |

| 5-Year Avg | 10.24% | 7.49% |

Although, Fundrise is outperforming most public real estate investments through 2019, this might not happen every year. As you can see in 2019, Fundrise fell way short of the REIT market. However, every year before that Fundrise has continued to outperform the index.

How Does Fundrise Work?

Not every real estate project receives funding from Fundrise. In 2015, only 2% of over 2,000 proposals received funding. This high rejection is on par with other crowdfunding sites.

Before Fundrise approves a project, it undergoes this vetting process.

Initial Submission

Real estate companies send funding requests to Fundrise.

Basic Screening

Fundrise removes all proposals that don’t meet basic underwriting criteria.

Detailed Underwriting

A Fundrise team visits the potential property. An in-depth analysis of the local area and investment potential is performed too.

Final Approval

If the project passes the in-depth analysis, Fundrise offers financing. The interest rate and is determined by the borrower’s risk rating.

When possible, Fundrise tries to be the primary lender. This reduces risk of loss if the project goes bankrupt.

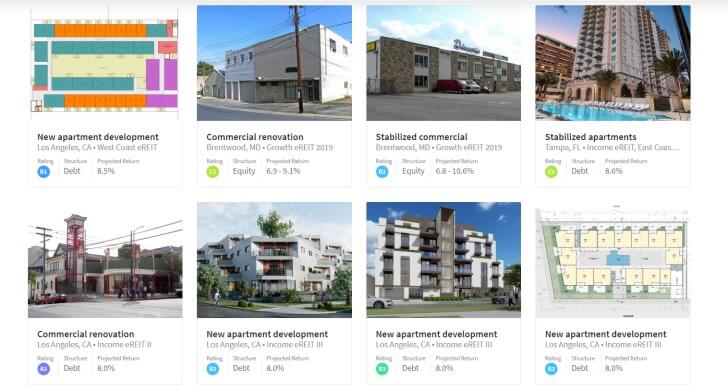

Fundrise Risk Rating

Each approved property receives a risk rating. The system ranges from A to E with “A” being the least risky. Most properties either have a “B” or “C” risk rating. While the income potential isn’t as high as a “D” or “E,” the chance of default is lower too.

You can browse the active and past properties in each eREIT. In the property listing, you can see the risk rating, the rate of return, and the debt type.

Although you can’t invest in individual properties, looking at the portfolio before you invest is helpful. With this information, you know what property types you invest in. And, it helps you know Fundrise is legit.

If you live near a project, take the time to inspect it yourself. Then compare your thoughts to Fundrise in-depth analysis.

What Does Fundrise Invest In?

Before you invest in any stock, bond, or real estate project, you must understand the investment. You need to know what you’re investing in. And, you need to know how the investment makes money. More importantly, you need to understand how it loses money.

What makes Fundrise unique is that you invest in private real estate. You own a direct stake in many real estate projects. With each investment, Fundrise divides your money among the different properties.

Because Fundrise is open to non-accredited investors, your only investment options are real estate investment trusts (REITs). Fundrise calls them eREITs, but they’re basically the same thing. With a Fundrise eREIT, the Fundrise team picks which properties to invest in.

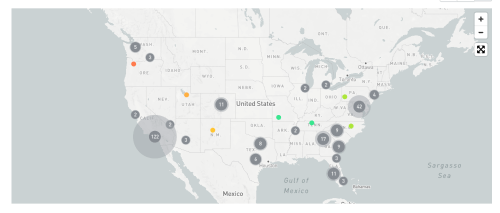

Each eREIT has a different investing theme and strategy. Some focus on earning monthly dividends and others emphasize appreciating property values. Also, some eREITs only invest in certain geographic areas like the U.S. East Coast, Midwest, or West Coast.

Fundrise invests in these U.S. property types:

- Multifamily Apartments

- Single Family Townhomes

- Shopping Centers

- Office Buildings

By owning commercial and residential property, Fundrise diversifies your investment. Both real estate markets perform differently.

Many people have ambitions of owning rental property. But, they don’t have the time, cash, or desire to own physical property. Fundrise helps bridge the gap. You can directly invest in residential and commercial real estate projects with a $500 minimum initial investment.

Each of properties above are currently active projects. As you can see, each has the rating, the structure (debt or equity), and the projected return.

Also, each real estate project is either an equity or debt structure.

Debt vs. Equity Real Estate

When you look through the different properties, you will see either debt or equity financing in the description.

To new real estate investors, these two terms are confusing. So, let’s cover them first.

Debt Investments (Income)

- Lower risk and lower reward

Think of debt investing as getting a bank loan. In this case, you’re the bank and receive a monthly interest payment from the borrower. Most Fundrise debt investments are to improve apartments. Each month, Fundrise collects a fixed payment until the loan is paid in full.

Fundrise calls these payments dividends. It’s like the money you get from an interest-bearing savings account each month. And, the dividends deposit in your account quarterly.

Debt investments are less risky, but they have less income potential too. If a project fails, debt investors are usually the first to get paid.

Equity Investments (Growth)

- Higher risk and higher reward

With equity investments, you own a piece of the property. Instead of receiving fixed monthly dividends from interest payments, you earn money in two different manners:

- Rent payments

- Appreciation after the property sells

There are a few different types of equity investments Fundrise participates in. Some projects are “Preferred Equity” that’s more of a medium-risk financing. You still earn some fixed dividends, but you still rely more on appreciating property values.

With most equity investments, you don’t see large gains until a property sells for a profit. In other projects, Fundrise may increase the monthly rent to boost returns as the property value increases too.

Potential Investment Risks

So far, Fundrise produces annual positive returns each year. But, there are potential investing risks.

Investment Property Goes Bankrupt

If a property goes bankrupt, Fundrise investor must take the outstanding balance as a loss. Thankfully, Fundrise invests your cash in a basket of properties. So, you should have more winners than losers.

Property Values Don’t Appreciate

Equity investments depend on rising property values to reach the higher projected returns.

Sometimes, property values remain flat or continue to depreciate. Fundrise tries to buy growth properties for below potential market value. Doing so limits downside risk, but the local real estate market must support higher prices.

If it doesn’t, Fundrise may sell for a loss when the investing period ends.

Fundrise Investment Plans

To some extent, you can choose which Fundrise eREITs you invest in. But, you must select one of four investing plans.

| Starter | Core | Advanced | Premium | |

|---|---|---|---|---|

| Minimum Investment | $500 | $1,000 | $10,000 | $100,000 |

| Target Diversification | 5-10 projects | 40-80 projects | 80+ projects | 80+ projects |

For the purpose of the is post, we are only going to focus on the first two options: Starter and Core

With each plan, you pay the same flat fee of 1%:

- 0.15% advisory fee

- 0.85% management fee

Tip: Besides reading these brief descriptions, read each plan offering circular. These circulars are similar to an ETF prospectus. It tells you all the fund fees, potential risks, and investing strategy.

Fundrise Starter Plan

Currently, the investment allocation for the Starter Plan is:

- Income eREIT 2019: 40%

- Growth eREIT V: 20%

- Growth eREIT II: 20%

- Balanced eREIT: 20%

With the Starter plan, you can get started with only $500 minimum and they also offer a 90-day risk free grace period if you decide to change your mind on your investment. Your investment will be inside a diversified portfolio of real estate projects located throughout the United States that Fundrise identifies, acquires, and manages on your behalf.

For example, this is where you can expect your Starter Portfolio properties to be. Of course, the cities can change as Fundrise adds and sells properties.

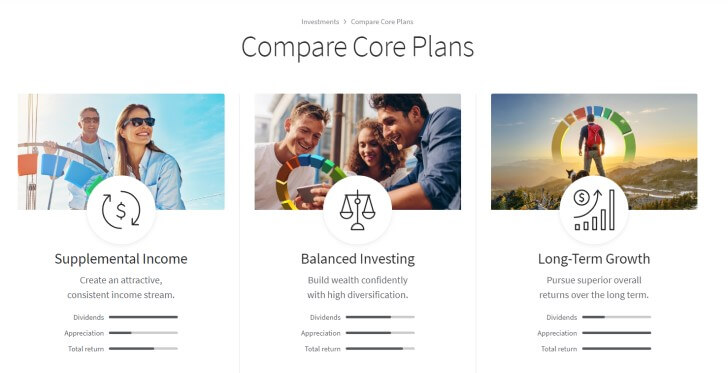

Fundrise Core Plans

Once your balance reaches $1,000, you can pursue one of three advanced investing plans. If your investing goals change, you can easily change which plan you want.

Supplemental Income

- 74% Debt and 26% Equity Investing

- Projected dividends between 3.1% – 3.4%

- Projected appreciation between 5.65% – 6.8%

- Projected annual returns between 8.7% and 10.3%

This is the least risky of all investing plans. If you LOVE dividend income, this is your plan.

You won’t earn the most income, but you don’t have to rely on appreciating property values to earn larger returns.

As of this review, the Supplement Income plan holds the following eREITS:

- Income eREIT (40%)

- East Coast eREIT (30%)

- West Coast eREIT (30%)

27% of Core investors choose this plan with an average investment of $6,251.

Balanced Investing

- 64% Debt and 36% Equity Investing

- Projected dividends between 2.5% – 2.8%

- Projected appreciation between 6.2% – 7.5%

- Projected annual returns between 8.8% and 10.3%

This is the most popular of the advanced investing plans. The balanced investing strategy favors dividends, but you still have plenty of upside potential with equity investing too.

Having the balanced plan also lets you invest in all of the Fundrise eREITs:

- Income eREIT (20%)

- East Coast eREIT (20%)

- West Coast eREIT (20%)

- Growth eREIT II (10%)

- Growth eREIT VI (10%)

- Balanced eREIT (20%)

This is the most popular of the Core plans, with 42% of investors choosing this plan with an average investment of $6,376.

Long-Term Growth

- 57% Debt and 43% Equity Investing

- Projected dividends between 1.5% – 1.7%

- Projected appreciation between 7.6% – 8.5%

- Projected annual returns between 9.1% and 10.1%

Young investors might prefer the long-term growth investing plan. And, since you have to hold any Fundrise investment for five years for penalty-free withdrawals, you may decide to go all-in.

- East Coast eREIT (10%)

- West Coast eREIT (10%)

- Growth eREIT II (10%)

- Growth eREIT VI (30%)

- Balanced eREIT (40%)

31% of Core investors choose this plan with and average investment of $6,847.

Most of your income from this plan comes from rising property values. When Fundrise sells their investment stake, you receive a cut of the profit. You will also receive quarterly dividends from the debt investments.

To maximize growth potential, Fundrise looks for properties in growing areas. When possible, they invest in new or existing properties selling at a discount. So, they may “fix and flip” apartments. Or, finance new construction on vacant land.

Navigating the Fundrise Platform

Fundrise makes their platform easy to navigate. Although you must decide which investing plan to follow, Fundrise does the most of the work for you.

Recent updates make Fundrise more transparent. Now, you can instantly track your investing progress. And, you can see what project you’re investing in and why Fundrise holds them.

Before these updates, a common investor complaint was the lack of transparency. It no longer seems like your sending money to an online company and hoping it’s legit.

Try Fundrise Platform for Free

Joining Fundrise is easy. You only need to enter your personal information to create an account.

And, you can browse the platform for free.

Then, you must fund at least $500 from your bank account to make your first investment inside the Starter Plan. If you decided to increase your investment to at least $1,000, you can move up to one of the three Core plans.

Also, you have a 90-day satisfaction period. If you decide Fundrise isn’t for you, they refund your money penalty-free. After three months, you pay a redemption policy up to 3% during the first five years.

If your account balance is less than $1,000, Fundrise automatically enrolls you in the Starter Portfolio. Once your balance reaches $1,000, you can remain in the start portfolio or choose an advanced plan.

From personal experience, the Fundrise platform is easy to navigate.

What I Like About Fundrise

- $500 Minimum: One of the lowest minimums for real estate crowdfunding.

- Non-Accredited Investors Welcome: One of the few real estate platforms for the non-rich.

- Different Investment Strategies: Can pursue income, growth, or both!

- Instant Diversification: Fundrise invests in many residential and commercial projects. This limits downside risk so you earn a profit each year.

- 90-Day Satisfaction Guarantee: You have three months to try Fundrise penalty-free.

What I Don’t Like About Fundrise

- Expensive IRA Option: You must pay a $125 annual fee to the third party IRA custodian

- Illiquidity: Can’t easily sell assets. Must wait five years to avoid the early redemption fee.

Fundrise FAQs

After being a member with Fundrise and asking others about the platform, here are the most common questions you will hear asked.

Is Fundrise a Legitimate Platform?

Yes.

Fundrise is a real company that pays you real money. They are also regulated by the Securities and Exchange Commission. And, they send you a federal tax document each year.

Each month, you can also print off your monthly account statement to track your account balance too.

Is there an investment minimum?

The only investment minimum is the required $500 to open an account. After that, you can invest as much as you want.

Fundrise invests all your money according to the plan you choose. If you begin with the Starter Plan with $500, then $250 goes to the Income eREIT and $250 to the Growth eREIT.

You can also schedule auto-investing for free.

When does Fundrise pay dividends?

Fundrise pays dividends quarterly from Fundrise. You can track your dividend progress in real-time on the Fundrise dashboard.

And, you can either reinvest your dividends or deposit the earnings in your bank account.

What fees does Fundrise charge?

You pay 1% in annual fees on your Fundrise balance. If you invest $500, Fundrise keeps $5 each year plus 1% of the dividends you reinvest.

Also, each eREIT may have their own fund fees. For example, you might pay a 2% agent fee if Fundrise sells a property. These fees are relatively uncommon. But, it’s something to be aware of.

What are the Fundrise redemption fees?

Fundrise processes redemption requests at the end of each quarter. After the quarter ends, it can take 60 days to receive your cash.

There is also a tiered redemption fee depending on how long you hold your investments:

- First 90 days: 0% fee

- 91 days to three years: 3% fee

- Three years to four years: 2% fee

- Four years to five years: 1% fee

- After five years: 0% fee

How are Fundrise earnings taxed?

Each year, Fundrise sends you the proper tax documents. You receive a 1099-DIV for each eREIT. Long-time Fundrise investors who invest in eFUNDs receive a Form K-1.

Unless your eREITS are in an IRA, your dividends are taxable income each year. Unlike public REITs, they don’t receive the lower capital gains tax rate.

Does Fundrise have an IRA option?

Yes, but it’s not cheap. You must create a self-directed IRA with Millenium Trust Company.

Each year, you must pay a $125 annual fee for each eREIT in your IRA. The annual cap is $200. If you own at least four eREITs, the most you pay each year is $200.

This fee doesn’t apply to any non-IRA holdings. But, you will have to report your earnings as taxable income each year. So, you must decide if the fee is worth the tax savings.

My Takeaway on Fundrise

As a user, my opinion is Fundrise is the great addition to diversify your portfolio. I myself would never put all my nest egg into just real estate, but I like the idea of diversifying into private real estate. And, if you don’t have the large upfront capital of $50,000 or more to get started in private real estate, Fundrise is a wonderful option.