Whether it’s open enrollment time or you’re looking to make a change, a health savings account may be a great option for you. There are many things you need to look at each year, however one of the most important pieces of a solid financial plan is with your health insurance.

Contents For This Post (Click to Open)

Health Savings Account (HSA)

Although HSAs have been around since 2003, you may have only started hearing about them in the last few years. More and more people are starting to jump on the HSA bandwagon, and for good reason.

In fact, I believe the future use of the HSA will become as normal as investing money in your 401(k). It’s what rich people use and I am a big fan of simply copying what rich people do!

If you are wondering if an HSA is right for you (it is) and you want someone to explain it to you in normal-human talk, look no further 🙂

What is a Health Savings Account?

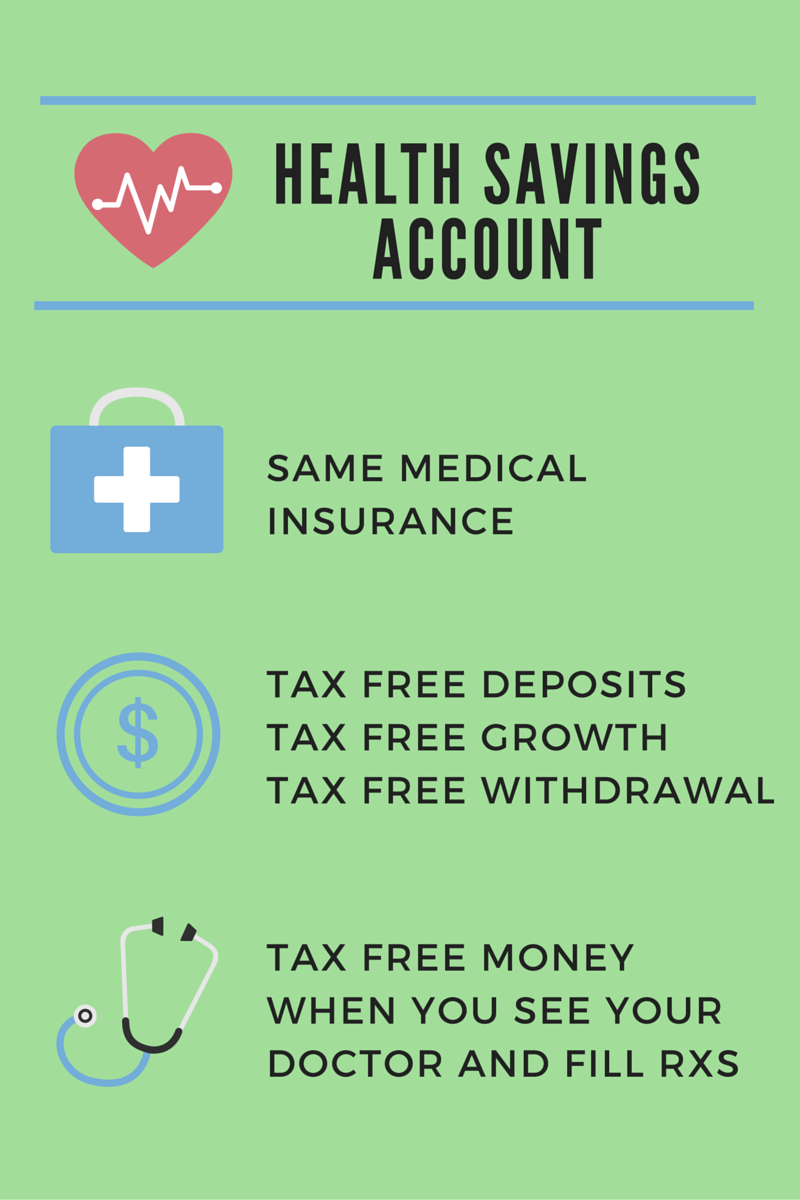

HSAs are a way for people to utilize huge tax advantages while paying for medical expenses. These huge tax advantages come in the form of three separate tax savings:

- Any money that goes into your Health Savings Account is either pretax through your employer or tax deductible if you are on your own

- The money inside a Health Savings Account will grow tax free inside of investments

- The money inside your Health Savings Account can be withdrawn tax free if used for qualified medical expenses

Any money you contribute to your HSA is your money and it goes with you when you leave your job. Think of it as having the same benefits of your 401(k) on the front end and your ROTH IRA on the back end, keeping the government off of your hard-earned money.

Related: Money Peach Podcast EP015: Tax Free Dollars for Health Care via the HSA

What’s the Catch?

Since the government is letting you spend some of their money on your medical expenses, you guessed it – there’s a catch. What could it possibly be?

First of all, in order to open up a HSA, you must be enrolled in a high-deductible health plan (HDHP). Basically, a HDHP transfers some of the risk away from the insurance company and onto you. This will earn you a lower monthly premium for taking on the extra risk.

In addition to lower premiums, you get to use tax-free money to use towards your deductible via the Health Savings Account. In a nutshell, you are increasing your risk via your higher tax-free deductible and in return receive lower monthly premiums. Your tax-free deductible is discounted at your tax bracket. For example, if your income is $50k/year in 2019, you would basically be receiving a 25% discount on your medical expenses.

In 2020, the minimum Annual Deductible Limits in order for a plan to qualify for a HSA:

- Single Coverage: $1,400

- Family Coverage: $2,800

Employers are dumping FREE money into your HSA account each year

With the higher deductible plan comes another great perk:

Employers know since we are willing to take on a little more risk with our health care, then we are probably going to think twice about going to see our primary care doctor because of a nasty hang nail.

The result is huge savings for your employer and often a small kickback for you. In fact, a recent study show employers whose companies have more than 500 employees are contributing on on average $500 for singles and $1,000 for families.

Related: The alternative to the Affordable Care Act can save you $1,000s each year

HSA example:

I just threw a bunch of numbers and facts at you, but let’s put this into a real world scenario. I am going to actually give you my exact numbers to show you how “real world” the savings are.

My employer (I am also a firefighter – check out my About page) offers a HDHP alongside our PPO plan. Here are the numbers:

PPO Plan for Family without HSA:

Yearly Premiums – $4,192

Annual Deductible – $2,250

PPO Plan for Family with HSA:

Yearly Premiums – $3,258

Deductible – $3,000

Results:

Yearly Savings in Premium = +$934

Money added by Employer each year = +$1,000

Extra Risk Taken on (Deductible) with HSA = -$700

As you can see, the savings are $1,934 (lower premium and employer deposit) and the possibility of out-of-pocket deductible is $700 more with the HSA. However, this doesn’t take into consideration that the $700 is tax-free. Therefore, if I am in the 25% tax bracket, the equivalent of $700 after taxes is really closer to $525. I am saving $1,934 per year with the extra risk of $525 (25% tax bracket) which tells me this a no-brainer.

**Not everyone will have the same results, so check with your HR department prior to simply signing up.

Health Savings Account Breakdown

Here are the most common questions I receive about the HSA

-

What is a qualified medical expense?

- Medical

- Dental

- Vision

- Prescriptions

- COBRA Premiums

- Medicare Premiums

- Medicare Part B ($144.30 per month in 2020),

- Tax-free HSA withdrawals to pay Medicare Part D and Medicare Advantage premiums

- Portions of your Long-Term-Care Premiums (based on age)

-

What about Preventative Care such as annual checkups, pre-natal care, child immunizations, and tobacco cessation programs?

- An HDHP may provide preventive care benefits without a deductible or with a deductible less than the minimum annual deductible. Either way, it’s a win for you

-

Is there a penalty for using the money for non-medical expenses?

- Heck yes there is. You will not only be taxed on the withdrawal, but will also pay a 20% penalty. Plain and simple – don’t do it. There is an exception to the penalty – see below

-

What if I don’t need the money, can I carry it over each year?

- Yes! It is your money and you take it with you wherever you go. However, at age 65 (or when you apply for Medicare) you can no longer deposit money into an HSA. Also, at age 65 (or when you apply for Medicare), you can take the money out of the HSA for non-medical without a 20% penalty, however you will pay income tax on the withdrawal amount

-

Can I pay for over-the-counter meds using my HSA?

- Only if you have a prescription from a doctor for a OTC medication

-

How much can I contribute to my HSA in 2020?

- Single Coverage = $3,550 including any money deposited from employer

- Family Coverage = $7,100 including any money deposited from employer

- At age 55, you are allowed an extra “catch up” contribution of $1,000 each year

-

My employer doesn’t offer an HSA, can I still open one on my own?

- Absolutely, and you should. You can see a list of the top banks and brokerage firms offering HSA plans by Clicking Here

-

How do I grow my HSA tax-free?

- The bank or brokerage firm you open your HSA will provide you with investment tools usually in the form of mutual funds. Depending on your income, the growth of your money inside an HSA will save you 15% – 20% in the form of capital gains tax

-

How do I pay for medical expenses tax-free?

- Most banks/brokerage firms will issue you a debit card linked directly to your Health Savings Account. If you forget your card, you can pay for it with your normal means of payment and reimburse yourself from your HSA

-

Is there an income limit to opening a HSA?

- No

-

Is it awesome?

- Yes of course!

Open up an HSA and layer your financial plan with another tool to support your emergency fund and retirement. If you start early enough, you will have plenty of tax-free money to utilize when you are in your later years when medical expenses cost $ insert insane amount here.

If you are unsure about it, simply get a calculator out and do an HSA analysis just like the one I did above. Even if we knew we were going to have a baby next year and hit our deductible in the first hour of the year, we would open up our HSA because in the scenario from the example above – we are still saving money. However, not everyone’s situation is going to be identical, so do a break-even analysis first.

The Takeaway

First you will need to do a break-even analysis.

Simply ask yourself this:

How much more risk am I taking on in form of deductible and how much will I be saving with lower premiums and free money from my employer (if any)?

Then, factor in my tax bracket.

Chris Peach Tip: Have an Emergency Fund of at least your deductible in place prior to opening up your HSA just in case you break your femur the first week of January.

4 Comments

Hey Chris, Thanks for the info. I have been thinking about this one for the next year. I think i’m still a little confused about the big picture of it, having 4 kids. I think i’ll have to run actual numbers when our open enrollment comes around, but it sounds like I may want to enroll in this vs. our regular plans. Thanks again for the info. Trace

Interesting, I never knew you can do a HSA as an individual (I am retired). I definitely have to look into this.

My insurance premiums come out a pretax basis (no fica, medicare, fit, or state income tax). When determining the risk/reward analysis, I was thinking we’d want to convert the amount in savings between plan premiums into an after tax amount. So in other words, how much is the $881 in after tax dollars, since that’s what the family keeps by having the hdhp. It reduces the amount saved by a bit, but the winner still seems clear, dependent upon copay % and catastrophic limits involved. I definitely think converting the difference in deductibles into pretax dollars for a true sense of the risk is very insightful on your part and helped me get my head on straight

Bill, I’m glad I could help. Remember, with the HSA, the money going in is tax free, grows tax free, and will be withdrawn tax free if used for qualified medical expenses. Also, your pre tax savings will be equivalent to whatever tax bracket you are in.

Thanks for the comment Bill:)