If you’re like many people these days, the incredibly high cost of healthcare thanks to the “Affordable” Care Act could be putting a serious dent in your pocketbook.

Personally, we are lucky to have a good insurance plan through my husband’s job where we pay about $200 a month in premiums for our family of six to have healthcare, dental and vision coverage.

However, if we had to use an Affordable Care Act plan from our state, our monthly premiums would rise up to a whopping range of between $1,393 and $1,883 a month depending on which plan we chose.

What would we do if for some reason my husband’s employer-available insurance went away?

We’d likely look into health sharing plans.

Health sharing plans are a different form of health care coverage. Although they’re not technically insurance, many health sharing plans do qualify as an alternative to Obamacare coverage.

One popular health sharing plan is offered from a company called Medi-Share.

What is Medi-Share?

I first learned about Medi-Share nearly eight years ago when Rick got laid off from his job as a result of the Great Recession fallout.

I was talking with a friend about concerns over health care coverage for our family of six since Rick was jobless. Kathy mentioned that for several years she and her husband (both are self-employed) had been members of Medi-Share.

Medi-Share had covered a good portion of Kathy’s medical expenses through a variety of maladies including knee replacement surgery and breast cancer.

She shared how comforting it was knowing that they had reliable financial help through trying times, and I’m happy to report that today Kathy is healthier than ever.

However, it’s important to keep in mind that Medi-Share is not an insurance company; instead it’s a Healthcare Sharing Ministry.

Do I Pay a Penalty if Since I Don’t Have Insurance?

No, you do not.

The penalty for skipping out on enrollment into Obamacare was $695/person for up to 3 people in your family or 2.5% of your modified adjusted gross income in 2017 and is expected to go up in 2018.

Therefore, if you were a family of 3 making $50,000/year, the penalty would be a minimum of $2,085. If you were a family of 3 making $100,000/year, the penalty would climb to $2,500 and you still wouldn’t have insurance.

However, when the Affordable Care Act when into law, there were certain groups immediately made exempt from the ACA:

- Member of Congress (shocking)

- Native American living a Federally recognized tribe

- Homeless making less than $10,000/year

- Illegal alien

- Amish or Mennonite

- Incarcerated prisoner

- Member of recognized health share ministry

Therefore, if you become a member of a health share ministry, the government labels you exempt from the large penalty come tax season.

**Section 1501, page 148 of the Affordable Care Act holds a provision establishing that members of Healthcare Sharing Ministries like Medi-Share are exempt from the requirement of Obamacare or an alternative insurance company plan.

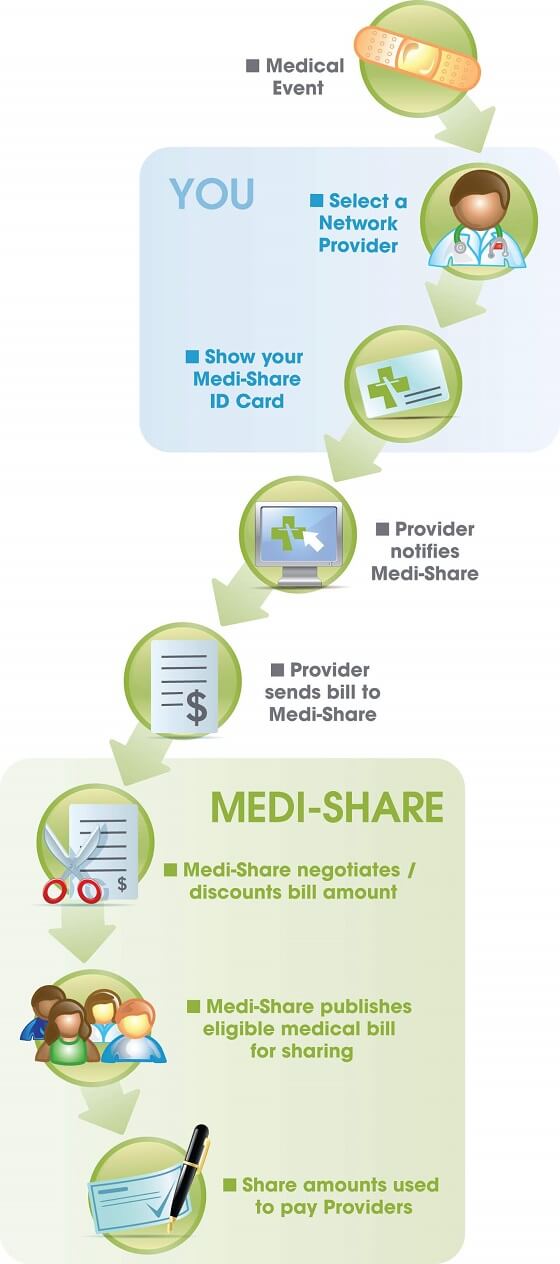

How Does Medi-Share Health Sharing Work?

As I mentioned earlier, Medi-Share is not an insurance company.

Although it seems like an insurance company – premiums are paid and then used to fund medical expenses – Medi-Share works a bit differently than insurance companies do.

Instead of being an insurance company, Medi-Share pays members’ medical expenses via a sharing program.

It works like this: members pay their monthly premiums, which all go into a big “pot”, i.e. an account at a credit union. Each member has their own account within the big account.

As medical expenses arise for members, they’re paid out of the credit union account based on the terms of the plan the member signed up for. One way to describe these types of health sharing ministries is that they’re kind of like crowd-funded healthcare.

Your Annual Household Portion (AHP) is the amount of medical expenses you pay out of pocket before coverage kicks in.

As a member, you choose your AHP along with your monthly share cost.

So, for instance, if you want to pay $10,000 out of pocket before coverage kicks in, you’ll pay $228 per month (the standard monthly share amount), or only $187 per month if you can qualify for the Healthy Monthly Share amount.

*All program options are per-household.

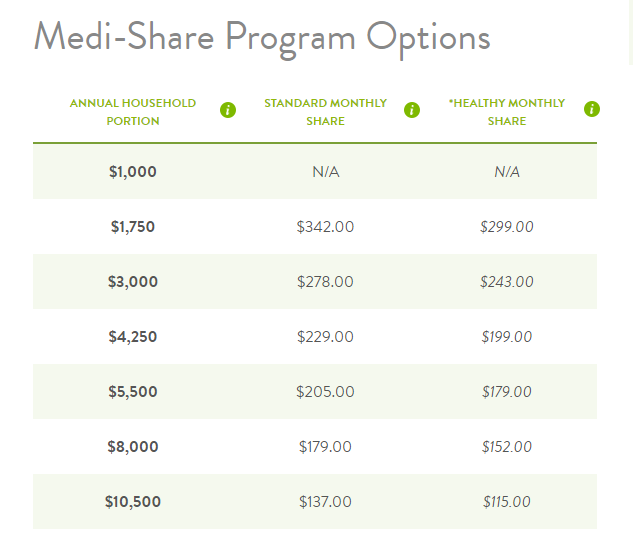

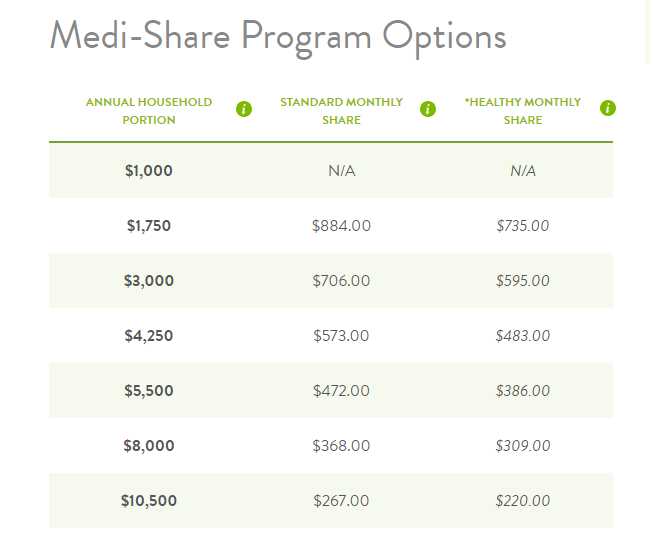

What Does the Cost of Medi-Share Look Like?

Medi-share has their standard pricing which you can see in the first image below. Each household’s monthly share is based on the age of the oldest applicant and how many family members are participating.

Now, here is result for a family of 3 or more and the oldest age of applicant set to 35-years-old using the Medi-Share calculator for the Peach family:

**As you can see from the two screenshots above, the comparison with Medi-Share versus Obamacare is drastically different in your monthly and annual costs.

What Types of Health Expenses Does Medi-Share Cover?

Medi-Share has a large list of covered expenses for medical, dental and vision needs. They also have some expenses that are only partially covered and some expenses that are not covered at all.

For instance the company will not cover expenses that don’t line up with biblical values. Also, some pre-existing conditions require members to pay a premium add-on.

Medi-Share also provides incentives for choosing a healthier lifestyle that can result in lower premiums.

Another bonus is that Medi-Share does not impose annual limits or lifetime limits.

As I mentioned earlier, my friend Kathy was covered for expensive health occurrences such as knee replacement and cancer, so you can be sure that Medi-Share isn’t skimpy where coverage is concerned.

Who Qualifies for Medi-Share?

Medi-Share, also called Christian Care Ministry, requires that all members age 18 and older “must attest to a personal relationship with the Lord Jesus Christ.”

In other words, it’s an organization that was founded for Christians. The company has some pretty strict standards for members, but it is those strict standards that helps keep the company financially sound and able to keep monthly costs so incredibly low.

Here’s an excerpt from their web site that details what Medi-Share requires in terms of basic qualifications for members over 18 years of age:

All Members Agree to the Following

• Live by biblical standards

• Believers are to bear one another’s burdens

• Attend and actively support a fellowship of believers regularly

If you’ve met the criteria of having a personal relationship with Jesus Christ, you can apply for membership and health cost coverage through Medi-Share.

[Note from founder of Money Peach, Chris Peach]

Many people have asked what actually constitutes as biblical behavior and we went straight to Medi-share for the answers. Here is a brief summary of what they have published on their website in what they refer to as a required Christian Testimony when applying to be a member.

Adult Members profess the following Statement of Faith to qualify for Medi-Share membership:

• I believe that there is only one God and He is all three: the Father, Jesus Christ the Son, and the Holy Spirit.

• I also believe Jesus is God, in equal standing with the Father and the Holy Spirit (Colossians 1:15-20, 2:9).

• I believe the Bible is God’s written word to man.

• I believe Jesus Christ was born to a virgin, led a sinless life, performed miracles on Earth, and predicted both his death, resurrection, and ascension to Heaven as the world’s only Savior and Lord.

• I believe man was created in the image of God, but because of sin was also separated from God. Therefore, by accepting God’s gift of salvation by grace through faith, man will be saved

In addition, any member applying for Medi-share must attest to a personal relationship with the Lord Jesus Christ and a church leader may be interviewed to verify their testimony.

As a loyal follower myself of Jesus Christ as my Lord and Savior, I would encourage anyone applying to health sharing ministries to understand and accept these terms before applying for membership 🙂

One Perk That Will Change Your Life

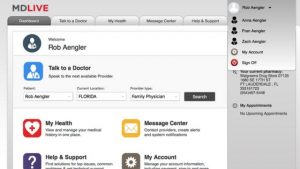

It’s called Telehealth – virtual medical care 24 hours a day, 7 days a week, and 365 days a year.

Telehealth is a better choice when you are sick, have a sick child, you don’t want to miss work, or when you are out of town.

Medi-share offers their program called MDLIVE at no charge to you which gives you around-the-clock access to a doctor via your mobile device.

When you factor in the savings of a $40 co-pay to a doctor visit, a $150 urgent care visit, or a $1,000 ER visit, and also the time and effort saved by visiting your doctor virtually, this FREE service is a game changer.

Other Questions You May Have

Here are some of the most common questions I receive in terms of leaving your high-cost insurance company for health share plans.

Who is Medi-Share For?

Medi-Share is for Christians who are looking for alternatives to the high cost of Affordable Care Act or employer plans. Whether you are an individual, a large family, or a senior, you will more-than-likely save money by switching from the Affordable Care Act to Health Sharing provided by Medi-Share. However, keep in mind that Medi-Share is

Who is Medi-Share Not For?

Medi-share does not allow use of tobacco or illegal drugs, abuse of legal drugs, nor do they allow sex outside of traditional Christian marriage.

Are Pre-Existing Conditions Covered?

Medi-Share does cover pre-existing conditions under certain circumstances.

Pre-existing conditions are covered up to $100,000 per member per calendar year if any of these conditions apply:

- The condition has gone 36 months without signs, symptoms, treatment or medications

- The member has been consistently active with Medi-Share for 36 months

Pre-existing conditions are covered up to $500,000 per member per calendar year if any of these conditions apply:

- The condition has gone 60 months without signs, symptoms, treatment or medications

- The member has been consistently active with Medi-Share for 60 months

What About Maternity Plans?

Yes you are covered, however you must have had health sharing in place prior to conception. Also, health sharing for maternity is limited to $125,000 for any single pregnancy event and includes the cost of delivery, any complications for both mother and child, and postpartum care.

You also must be assisted in delivery by either Medical Doctor, a Doctor of Osteopathy, or a licensed and certified Midwife.

What About PPO Plans?

Health sharing ministries will encourage members to use preferred provider organizations (PPO) because these providers have agreed to discount their fees to health sharing members. This results in significant savings for both you as the member and for the entire membership in the form of lower monthly share amounts.

You can search your doctor here to check if they are a PPO provider or not.

When is Health Sharing NOT a Good Plan?

If you’re someone who suffers from chronic health issues, you may actually be better off using Obamacare versus health sharing for health coverage.

If you can think of health sharing as you would your own homeowners or car insurance, then health sharing is a perfect fit. As with auto insurance, it is there to cover the very infrequent car accident. Health sharing works the same in covering the infrequent broken bone, heart attack, cancer, etc. and when you understand that health-sharing’s primary purpose is to offset the medical “burdens” members may experience, then it’s a perfect fit.

Therefore, if you are someone who anticipates an ongoing or chronic medical issue, then you may want to stick with the ACA.

What About Prescription Medications?

Prescription medications can be eligible for cost-sharing, but only for up to six months for the lifetime of the member. Again, this means if you are someone who requires expensive prescriptions, therapy, etc., you probably won’t benefit as much from switching to health sharing.

What About Routine Health Screenings?

Unfortunately, well-visits, routine care or preventive care are not covered for anyone over the age of six.

Remember, health sharing is NOT insurance and their primary purpose is to help share in other’s member’s medical burdens, not their routine healthcare. However, since your monthly share amounts are extremely low as compared to the affordable care act, this will allow you to budget accordingly for these planned visits.

What Are The Annual/Lifetime Limits for Payout?

Medi-Share has no annual or lifetime limits for payment of medical expenses.

Is Medi-Share Financially Sound?

Since 1993, over 400,000 Medi-Share members have shared and discounted more than $2.6 billion in medical bills!

What does the Future of Health Sharing Look Like?

While there is no way to predict the future, we can see that health sharing is becoming increasingly popular since the Affordable Care Act went into play. “When the law was passed, there were about 150,000 HCMS (health care sharing ministries) members in the U.S. Since then HCMS membership has grown more than 600 percent and can be found in all 50 states and seven U.S. territories” as was stated in a report on Health Sharing Ministries by Fox Business.

Is there Anyone I Can Actually Talk To?

Medi-Share has a customer service center that you as a member can call to get questions answered about your coverage and benefits. Customer service reps will even pray for you if you’d like.

A Health and Wellness Plan for You

Medi-share also offers health and wellness programs to help their members live a healthier life, thus reducing the costs for both individual members and the overall membership.

They offer each member “Health Links” which are online resources for members to educate themselves on living a healthier lifestyle. They also offer Health Coaching over the phone and “Care Managerst” to assist you in prayer, understanding your healthcare needs and coming alongside you to make sure healthcare professionals are acting in YOUR best interest.

A Community, Not Just a Company

One of the things I really admire about this company is that they have a commitment to maintaining a supportive community of members.

A neat way in which they foster this community attitude is that members are notified when their bills are paid by other members, and vice versa.

So as your monthly share amount goes into your separate Medi-Share account, and money is taken out of that account to pay someone else’s medical need, you get the notification of meeting that other person’s health need.

Similarly, if you have a medical need, money is taken from other members’ accounts to meet your need, and as they are notified of the help they’ve given you, you are also sent the names (first names only) of those who have given to meet your need.

The system also allows you as a member to send notes of encouragement to those your monthly share amounts have helped, and for you to receive notes of encouragement from others as well.

A Better Alternative to Obamacare

If you’re looking for a health insurance or Obamacare alternative that will make your health care costs more affordable and provide for support and encouragement as well, check out Medi-Share.

Full Transparency: Money Peach is an affiliate partner with Medi-Share and I receive compensation by referring visitors to them. It doesn’t cost you anything extra, but instead they send me a thank-you referral for sharing their program with Money Peach readers.

If you for whatever reason don’t agree with this and you still would like information on Medi-Share, simply close out this browser and visit their site in a new page.

Money Peach only allows tools and resources on their site that provide value and help you make the best decisions with your money. Therefore, if you are okay with the this arrangement, I would greatly appreciate it.

Questions or Comments?

Are you currently looking at health sharing as an option? Or are you someone who is part of a health share ministry and would like to share anything (both good and bad) about your experience?

With so many Americans who are financially impacted by the raise in premiums over the Affordable Care Act, we would all like to hear from you.

Please drop off a comment with your question or feedback and help the other readers navigate through the same questions and concerns you may have about health sharing.

Post your comment below and we will respond and notify you about it!

3 Comments

I use Liberty Healthshare, which has been amazing. It’s meant more for mostly healthy people, but my yearly AHP is only $500. I don’t get that nifty MDlive program though!

Yes, that’s a good alternative too!

My wife had synvisc injections in both knees a month ago. If she joins MediShare, will it cover knee replacement surgery?