The credit score is one the more important numbers in adult life, ranging from 300 to the perfect score of 850. Your ability to become a homeowner, to land a job, or to get the best interest rate is all tied back to your credit score.

Before credit scores, loans were made on a very casual basis and there was not a standardized method for determining the level of risk for lenders. Then in 1956, an engineer (Bill Fair) and mathematician (Earl Isaac) teamed up to create a credit scoring system. This would later become known as FICO.

Later in 1989, the first FICO scoring system was created and is used as the industry standard today. There are three credit bureaus that keep track of all the data to make up the credit score. They are Experian, Equifax and TransUnion.

Contents For This Post (Click to Open)

Why Your Credit Score is Important

Having a good credit score may make you feel good about your financial situation, but even broke people can have good credit scores. In fact, your credit score has nothing to do with how much money you have or how wealthy you are.

The credit score does one thing: it shows lenders the level of risk they are taking by giving you a loan.

If you have a high credit score, this shows lenders you are good at taking out credit and paying it back on time. If you have a low credit score or no credit score, then you are determined to be a higher risk to the lender.

Why This Matters

The higher the risk, the more you will pay.

Let’s say you have a friend who is extremely reliable, they always do what they say, and they’ve never let you down.

On the other hand, you also have a friend who never follows through with what they say, they never show up on time, and they owe everyone money.

If you were going to lend $1,000 to each of them, which one would you charge a higher interest rate? Your credit score works along the same principle.

The Breakdown of the Credit Score

The credit score is calculated by the Fair Isaac Corporation, which is also where the name FICO score comes from.

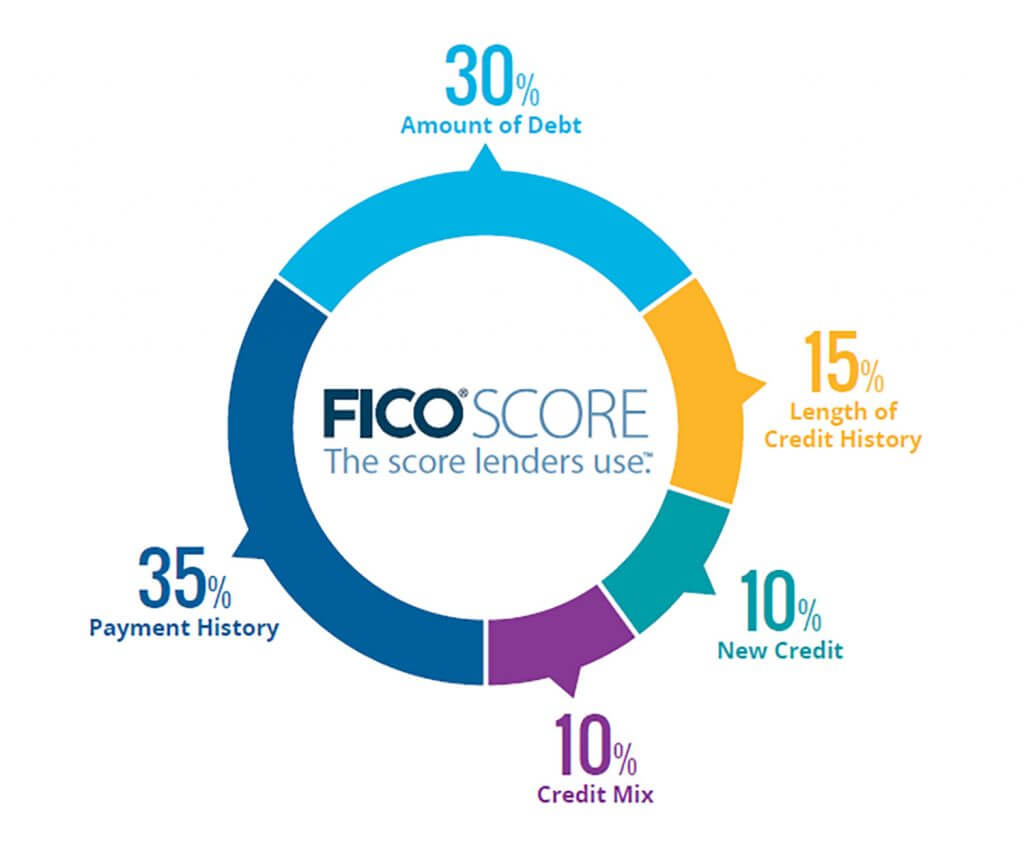

The score is calculated using data from your credit report broken down into 5 different categories. The categories are payment history (35%), amounts owed (30%), length of credit history (15%), new credit (10%) and credit mix (10%).

Payment History (35%)

The most important factor in determining your credit score is your payment history. The number one thing lenders want to know is if you have paid your past accounts on time. Since this information is the highest weighted out of the five categories, it will also have the largest effect on the change in your credit score.

In fact, one missed payment will stay on your credit report for seven years.

Amounts Owed (30%)

The second thing lenders want to know is the amount of debt you owe compared to how much you can actually borrow.

This is also known as the credit utilization limit and is calculated by your revolving credit.

Revolving credit is always open like a credit card, gas station card, or a home equity line of credit. Once you pay the loan off, you can immediately draw back from that same line of credit, which is why it’s called revolving credit.

Installment loan is a fixed loan with a set monthly payment and payoff date. Once the loan is paid in full, it is automatically closed and cannot be drawn from again. Typical installment loans are mortgages, auto loans and student loans.

A good rule of thumb is to keep your credit utilization below 30%. You can calculate this by dividing the amount of revolving credit you are using (debt) by the amount of revolving credit you have available.

Example: You have a credit card with a credit limit of $10,000 and a balance of $2,000. This means you’re using 20% of your credit utilization.

Pro Tip: The MyFICO blog recently reported that those with a credit score over 785 had an average credit utilization of 7%.

Length of Credit History (15%)

It makes sense that the longer you have credit available, the better idea lenders have on your behavior with credit.

Your credit history is based on the following:

- How long you have had your credit accounts, including the age of your oldest account, the age of your newest account and an average age of all your accounts

- How long you have had specific credit accounts

- How long it has been since you used certain accounts

However, there are still plenty of people who have high credit scores that do not have a lot of credit history. This is because your credit history only makes up 15% of your overall score, whereas payment history and credit utilization make up 65% of your credit score.

Credit Mix (10%)

A small percentage of your score is made up of the mix of different types of credit available. This can be a mix of credit cards, retail accounts, installment loans, finance company accounts and mortgage loans.

Lenders can get a better understanding at how you are at managing credit if they can see you can successfully manage all a mix of different types of credit. The better you are at managing multiple types of credit, the less of a risk you are to the lender.

Pro Tip: You may think you would benefit from opening multiple credit lines to increase your score, but this is never a good idea. Every time you apply for a line of credit, creditors do a “hard inquiry” to check your credit which will lower your FICO score.

Also, if a lender sees you have applied for credit multiple times in a short period of time, this could raise a red flag and you may not be approved for a loan. Lastly, keep in mind that credit mix only represents 10% of your overall score and will not be the deciding factor into whether you are or are not approved for a loan.

New Credit (10%)

At first glance, you may be thinking that new credit will improve your score. Why that is true, it’s also important to realize new credit could also decrease your credit score.

When you apply for a new line of credit, the “hard inquiry” is made by the lender, which will lower your score by a few points. Also, if you remember from above, new credit will decrease the length of your credit history by adding a new line of credit to the average overall credit history.

However, your score could also increase with new credit by diversifying your “credit mix” as mentioned above. In addition, your score may increase if you open a new line and never use it. This is because 30% of your score is made up of credit utilization and increasing your available credit without using the credit will lower your credit utilization percentage.

What is a Good Credit Score?

Credit scores range from the lowest of 300 to the perfect score of 850.

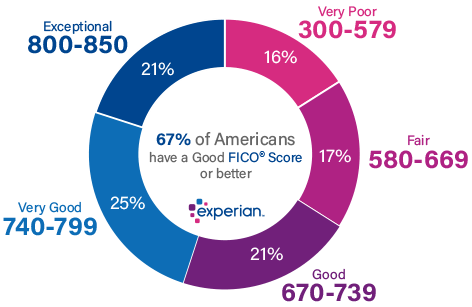

Exceptional Score (800 – 850)

Twenty-one percent of Americans fall into the “exceptional score”. This score will give borrowers the lowest interest rates, the best terms and the largest credit limits.

One thing to keep in mind is lenders are going to treat you the same if your score is 815 or 850. Even if your score is not a perfect 850, you’re still going to be treated by lenders as if you are a perfect score since you’re inside the exceptional range.

Very Good Score (740 – 799)

The majority of Americans, 25%, fall into this category. A “very good score” will get you above average rates and terms when you apply for credit.

Good (670 – 739)

While a “good” credit score still gives you access to good rates, terms and limits, but not the best. About 21% of Americans will fall into this range and unfortunately 8% of this group will become delinquent borrowers.

Fair (580 – 669)

People with “fair” credit are considered high risk to lenders. This group of borrowers are considered subprime borrowers and will have a hard time getting approved for loans. If they are approved, they will pay much higher interest rates than someone with even a “good” credit score. Currently, 17% of Americans are in this range.

Very Poor (300 – 579)

Those with a “very poor” credit score will most likely be denied credit. However, if they are approved for credit, the borrower may have to pay a high fee or deposit. If you are part of the 16% of Americans who are in this range, it would be wise to improve your credit score before trying to take out a loan.

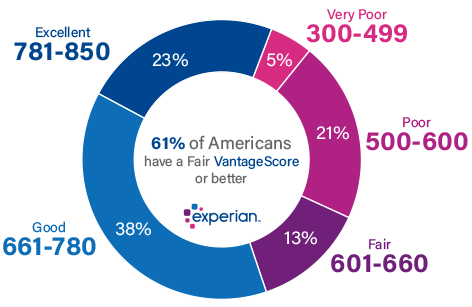

The VantageScore

Most of us are very familiar with FICO score, but did you know there is also a second score in the credit score industry?

The VantageScore was created in 2006 and while it is definitely not as well-known as the FICO score, it is a score used by some lenders.

But, not-to-worry, the VantageScore isn’t much different from the FICO score and the scores tend to mimic one another since they’re based on the same information from the three credit bureaus.

The big difference between the VantageScore and the FICO score is that the VantageScore combines all three credit bureaus (Experian, Equifax, and TransUnion) into one score. On the other hand, FICO really has three separate scores based on each credit bureau.

The bottom line is this: if you have a good or bad FICO score, the chances are extremely high that your VantageScore would be very similar.

A Good Credit Score is Worth $100,000

If you are getting ready to purchase a house and you have a “fair” credit score of 620, your interest rate will be 4.61%.

But, if you had a “good” credit score of 760 your interest rate would decrease to 3.029%.

Example:

$300,000, 30-year mortgage loan at 4.61% APR has a $1,539 monthly payment with $254,000 of interest paid over the life of the loan.

$300,000, 30-year mortgage loan at 3.029% APR has a $1,269 monthly payment with $157,000 in interest paid over the life of the loan.

As you can see, a “good” credit score (not a perfect score of 850) will save the borrower just under $100,000 in interest over the life of the loan.

Final Takeaway

Your credit score is a very important number but it does not represent wealth. It simply allows lenders to determine the level of risk they are taking by opening a line of credit to you.

So many people have fallen into the trap that a good credit score automatically gives the impression they are good with money. While there is some truth to this, a good credit score simply means you are good at borrowing money from different lenders and paying them back on time.

With that said, the best way to improve your credit score and maintain good credit is to never miss a payment, keep your credit utilization below 10% and only take out a new line of credit if it’s absolutely necessary.

Watch Interview with Credit Expert

Credit expert Chris Huntley from Credit Knocks came on the Money Peach Podcast Live show to talk about some of the little-known hacks when it comes to improving your credit score. You can watch or listen to the interview here.

One Comment

So that is where the Fair Isaac label came from! That’s great trivia. And of course one of them was a fellow engineer. My wife and I never borrow money, we buy cars with cash, paid the house off decades ago and have never failed to pay off every credit card every month for 40 years. Our credit score is 821 so we are proof you do not need to borrow money to build a good credit score, other than use a credit card and pay it in full every month. Unfortunately our credit score is relatively meaningless because we don’t borrow money and never will. But it does look good on paper I guess. Great post as always!