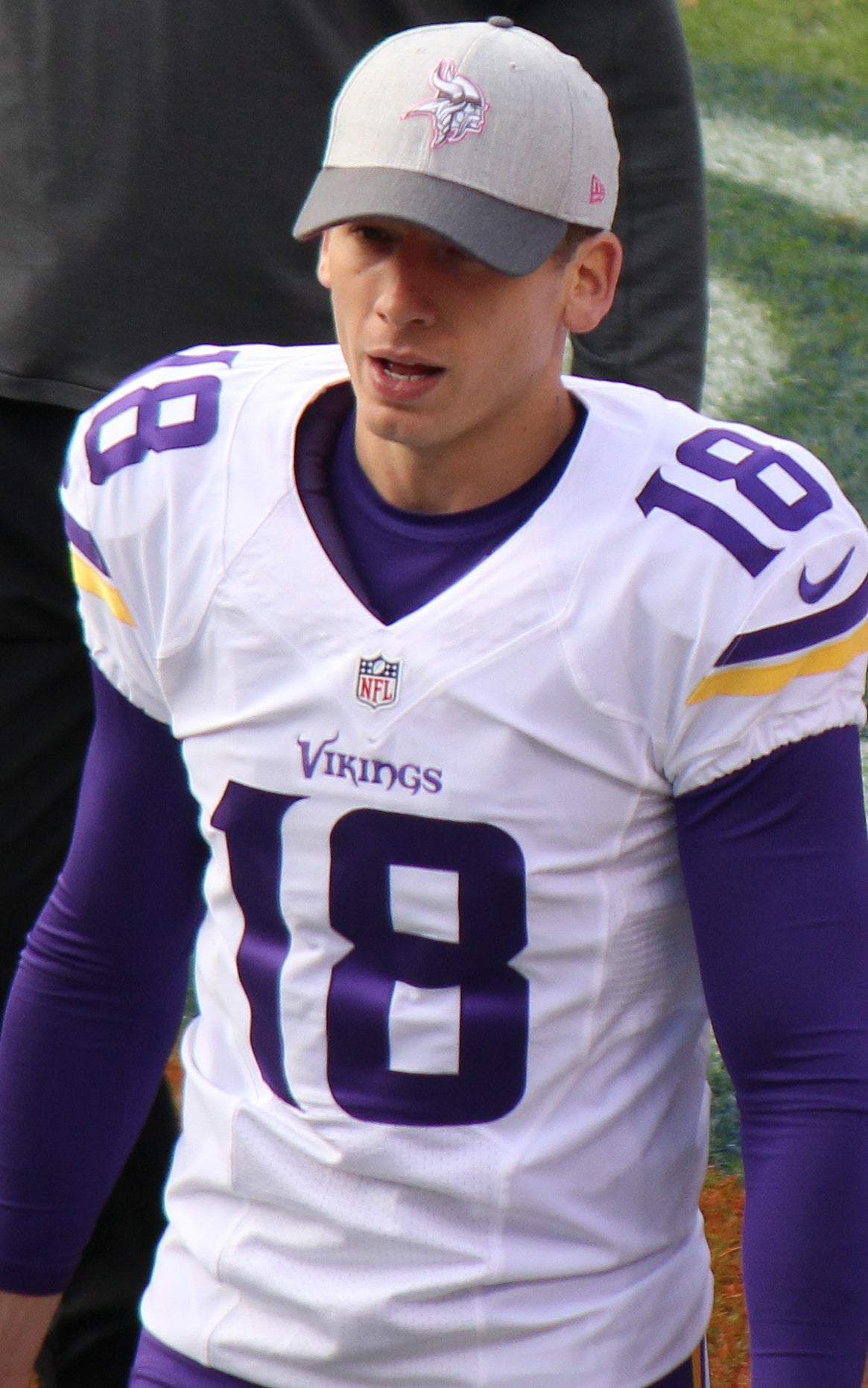

NFL players are known for their speed, strength, agility—and likelihood of going broke after leaving the league. Punter Jeff Locke not only defies that last stereotype, but is actively striving to reverse the troubling trend.

We talked to the free agent, who was drafted by the Minnesota Vikings in 2013 and most recently played for the Detroit Lions, about why so many players are at risk, his unconventional approach to help change that—and the money rules he lives by.

What’s the biggest financial challenge you’ve faced as a football player?

Most people don’t realize that teams only pay you during the season. Depending on the team, they’ll give you a check every week or every other week between September and December. You have to make four months of pay last 12 months.

In college, you’re living stipend check to stipend check if you’re on scholarship—and then all of a sudden, after your first or second NFL game, you get one check that equals two years of stipend checks. The urge is to spend it on everything you wanted.

I was lucky to get advice from my parents and their financial advisor. They told me I should only spend $X per month in season to budget for the other eight months.

Related: Why This Millionaire NFL Player Is Living on $60,000

In 2015, you did a five-week internship at an investment firm. What inspired your interest in finance?

I was an economics major at UCLA, so I’ve always been interested in money. I wanted real-life job experience in between seasons because I knew the average NFL lifespan is 3.5 years. I took that stat seriously.

Your bosses at the firm proposed that you investigate why so many athletes go broke. What did you discover?

It starts with spending habits, [but also] comes down to expectations versus reality. Guys see this figure they’re going to get paid without taking into account taxes, union dues, agent fees and living expenses—then that number comes out to be well below half what you thought. Players need to wake up to that reality.

Also, investing is a totally different language. Some financial advisors use that to their advantage when talking to a player. The player assumes that because they’re able to speak this language and give a fancy pitch, they can be trusted with money. I tell players that if an advisor cannot put his investing plan into terms you understand, he’s not right for you.

What strategies did you come up with to improve these issues?

I created and delivered a PowerPoint presentation about smart finances, and I try to talk to guys in the locker room. [In addition to] telling them to save as much as they can as early as possible, I try to help them vet financial advisors. I created an online questionnaire they can email to potential planners. The first goal is to weed out the really shady advisors—that alone will help most players.

How did your teammates respond?

Very positively. There is definitely a trust factor in information coming from another player who’s been in the locker room yet also has experience with this kind of stuff.

How has your own approach to finances evolved?

After my internship, I changed advisors. My present advisor is a fiduciary, so legally he has to look out for my best interests. Previously, I was with a commission-based advisor who only had to find ‘suitable’ investments. The suitability standard gives advisors leeway to pick investments [with higher commissions or fees].

What was the best financial advice you ever got?

My parents [taught me] the difference between a need and a want. We have needs, things we have to have each year to live on. Wants are very separate. Take a step back and say, do I really need this, or only want it for the enjoyment or status it’s going to bring me?

My parents [taught me] the difference between a need and a want. We have needs, things we have to have each year to live on. Wants are very separate. Take a step back and say, do I really need this, or only want it for the enjoyment or status it’s going to bring me?

I come from a military family, and that discipline carried over to how I spend money. I saw how my parents saved and were able to support [my brothers and me] and my athletic career. We didn’t go out to eat much. My mom kept us on budget.

What money rules do you live by?

I save as much as I can. And I understand compound interest [when the interest you earn on your money earns interest, and so on]. If I [invest] the majority of the money I make now, I know I won’t have to worry in the future.

Related: NFL Pro Brandon Lloyd’s Secret to Smart Spending Is a Lesson for Everyone

How about your best financial decision?

Choosing to do that internship. I was able to play with the firm’s retirement planning program, and saw that if you save X amount at X rate of return, these are all the possibilities for your total nest egg… If we can save and invest our money today, it’s going to pay dividends down the road.

What’s next for your football career?

I just finished playing in Detroit—I knew that was a temporary gig while [another player] was injured. Right now I’m trying out for other teams. Best-case scenario, I play for a team in the next couple of weeks and help them finish the year. Next year, I’ll sign with another team in the off-season and go through training camp.

This interview has been edited for clarity and brevity.

This post originally appeared on Grow.

Related:

Tony Robbins: 4 Traits the Most Financially Successful People Share