In 2019, credit card debt hit an all-time high of $1.09 trillion. This exceeds the pre-recession record of $1.02 trillion reached in 2008. With that said, Americans spent over $100 billion….in interest. Yes, one hundred billion dollars in interest TO THE BANK.

Ready for a wake-up call?

Here are the rest of the numbers:

The Bad:

Total credit card debt (2019): $1.09 Trillion – an all-time high

Interest paid to banks (2019): $100 Billion

The average credit card balance: $6,354

Number of credit cards per person: 3.1

Average interest rate: 16.97%

The Good News:

Credit Score Average (2019): 706 (highest average credit score since 2012)

What does this mean?

For starters, this means someone carrying a credit card with an average balance of $6,354 at an average interest rate of 16% will end up paying $150 minimum monthly payments.

If they continue to make the monthly payment and never use the card again, it will also take 24 years and 4 months to pay the balance. And, not to mention the total interest paid to the bank would be just under $8,000!!

If that wasn’t shocking enough, how about this?

The majority of people carrying credit card debt and paying insane levels of interest to the banks are also the same people with good to excellent credit scores!

So, the question now becomes why are banks charging outrageously high interest rates to those with good to excellent credit?

The answer is because the banks can.

Why would they change what is working so well for them?

Think about it: the higher the interest rate, the longer it keeps you a customer inside their plan. And, the longer you stay inside their plan, the better off they are.

The banks also make it complicated (and on purpose)

Have you ever wondered which card you should pay first?

Do I pay the one with the largest balance?

What about the highest interest rate?

Or how about the one with the highest minimum payment?

And how do I manage multiple cards with different due dates, different APRs, and different minimum payments each month?

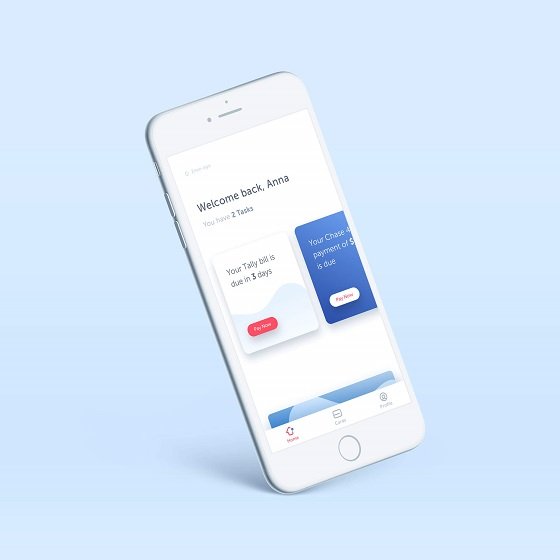

This is where Tally comes in and shines.

Tally: A Smarter Way to Pay Down & Manage Your Credit Cards

Product Name: Tally

Product Description: A mobile app using technology to find the most efficient way to pay down your credit cards as quickly as possible, while simplifying the process of managing multiple credit cards.

Offer price: 0.0

Currency: USD

Availability: OnlineOnly

Overall

-

Ease of Use

-

Availability

-

Cost

What is Tally?

Tally is the first fully automated debt manager for both iOs and Android.

Tally is the first fully automated debt manager for both iOs and Android.

Tally uses their algorithm to pay off your credit card debt in the most strategic way possible. This in turn eliminates the need for a PhD in finance in order to figure the best way to pay them off. Instead of trying to calculate when to pay off which card or which card to pay first, Tally does this for you.

Tally will also monitor your APRs and will extend you a lower line of credit to pay off the higher interest debt if you qualify.

How Does Tally Actually Work?

The Tally app is a free download. Once you upload your card into Tally’s mobile app, it will continually monitor your balances, each of your card’s interest rates and each due date for every card you add into the app.

Next, their technology goes to work for you to determine which card to pay first, based on factors such as APRs and credit utilization. The result is you are now paying your cards in the smartest way possible, which saves you on interest across all your cards while also guaranteeing you never miss a payment again.

How Does Tally Make Money?

Tally makes money by charging interest on the amount you borrow from them. They only make money if they can save you money, and that’s it. There are never any hidden fees or any other sneaky ways for Tally to charge you anything else.

What is Tally’s Line of Credit?

Tally has raised a total of $92 million in venture capital since their launch in 2015. One of the biggest reasons why investors are so eager to jump on board is because of Tally’s line of credit.

How does the line of credit work?

Let’s say you have a credit card with an interest rate of 22%. Upon approval for the line of credit, the Tally line of credit will begin sending payments to your card with the 22% rate and you will then start paying back the Tally line of credit at it’s lower interest rate.

According to their website, Tally’s APR on their line of credit will range between 7.9% and 19.9%. This will depend on your credit history and similar to credit card APRs it will vary with the market based on Prime Rate (accurate as of June 2018).

The minimum FICO score required for Tally’s line of credit is currently 660.

Also, keep in mind that Tally is still working simultaneously with their algorithm to maximize your use of funds, thus helping you pay off your credit debt quicker and at a much lower rate.

One thing to note is Tally does still encourage you to use your credit cards while they work alongside you to pay them down quicker. They separate the benefits of using your cards from the burden of managing them monthly, helping you better understand how the amount and timing of your monthly payments and interest rate impact your balances. Or, pause on heavier card usage and simply use Tally as credit card debt management tool.

What is Tally Advisor?

You’re probably familiar with a robo-advisor for investments, but what about debt? In August 2018, Tally Advisor was launched to be just that; a robo-advisor for the 99% of Americans with debt.

How Does Tally Advisor Work?

Much like how a robo-advisor uses your age, retirement date, and goals to create a portfolio, Tally’s advisor does this with debt. Taking into consideration your income, your monthly spending, and when you want to be debt free, Tally creates a debt payoff strategy for you.

Their algorithm goes to work and determines the optimum amount to throw at debt each month. The optimization is based on your goals, your monthly cash flow and even those possible financial setbacks.

Who Benefits From Tally?

If you’re someone who has multiple credit cards with all different APRs, due dates, and minimum payment amounts – Tally may be a good fit for you.

First, let’s assume you obtained your credit cards at a time when you had a lower credit score and therefore you were only offered a higher APR.

However, today your credit score has jumped up to from 550 to 710, but the banks won’t budge when you ask them to lower your interest rate.

Why would they want to?

Aren’t they doing just fine with you paying a higher interest rate?

Now, let’s assume this is the scenario for 3-5 of the cards you have and you’re also feeling overwhelmed juggling due dates, minimum payment amounts, and which card to attack first.

In summary, if you have good-to-excellent credit and you’re overwhelmed with trying to figure out how, when and which card to pay off first, Tally is going to be a great choice for you.

Who is Tally NOT For?

If you have the cash on hand to pay off your credit cards or you qualify for a zero percent introductory rate with another card, Tally may not be your best option. However, keep in mind introductory rates can often go away if you ever miss a payment. If you think this is even a possibility, then Tally would take care of that worry and still pay down your credit cards faster and save you on interest.

Plus, you may still want to use Tally as a safety net for late fees and the convenience of managing all of your cards in one place.

What I Personally Love About Tally

What really impresses me about Tally is they are solving a pain point for many Americans – how to help those with good to excellent credit who are stuck paying high interest credit card rates.

Another perk with Tally is the guarantee you will never miss another credit card payment. Maybe you have incurred a late fee in the past simply because you forgot to pay a card on time – not because you didn’t have the money.

Tally takes care of this by paying your minimum balance for you and even guarantees it which frees up a ton of stress in our financial lives.

What I Don’t Like About Tally

They have the opportunity to meet the need for millions of Americans, but right now they are only available in the following states:

Arizona, Arkansas, California, Colorado, Connecticut, Washington DC, Florida, Georgia, Illinois, Idaho, Iowa, Louisiana, Maryland, Massachusetts, Michigan, Minnesota, Missouri, New Mexico, New Jersey, New York, Ohio, Oregon, Oklahoma, Pennsylvania, South Carolina, South Dakota, Tennessee, Texas, Utah, Washington and Wisconsin..

However, Tally’s website does say they are adding new states on a regular basis.

Takeaway

At first glance, Tally seems to simply be a fancy way to refinance your credit card debt.

However, after diving into their platform and speaking with someone from Tally, it’s apparent Tally takes this much further. First, Tally utilizes technology to help you become more efficient with paying multiple cards. Secondly, Tally solves the problem of high interest rates for those with good-to-excellent credit.

And, instead of hiring a personal debt counselor to help with your debt, Tally automates this process for you at no charge.

In the end, Tally is making their money on their line of credit and you are saving money with their lower interest rate.

The real winners are you and Tally – the biggest loser is the bank.

What Do You Think About Tally?

I really would love to know…

How many credit cards do you currently have?

Do you think Tally would be a good option for you or not?

What else would you like to see Tally offer?

I would love to see what your thoughts are about it. Simply drop a comment below and I’ll get back with you.

5 Comments

Tally is a life saver. At first , i was a little bit reluctant to sign up , because Tally is not mainstream. But curiosity got the best of me one night after many days of research and reviews online. I signed up in the car and loaded all my credit cards on the app when i got home. Then the magic happened , Tally instantly approved me a credit line of $10,000 with less than 700 FICO score and no hard pull . And right away the Tally app initiated full payments on all of my credit cards dept ( except TD BANK) .

After all payments got reported my credit score went from 685 to 773 EXCELLENT !!!

What’s next ? I will pay Tally each month at a much lower APR and if i should use any of my credit cards going forward , Tally will pay them each payment cycle two days before due .

The best part in all of this is that ,

i can now get top tier Cards with Zero APR . Also cards with higher limits that would intern help me on utilization ratio.

Therefore with all this benefits I’m all in on Tally . I will give them 10×

I’m glad to hear that Tally is working well for your needs!

i initiated the process with Tally, got a $!5K line of credit approval but i stalled, needing more info. received follow-up email to reply or set up call to continue but my reply was undeliverable. why cant i get reply or talk to someone. That’s why i’m reluctant to continue – i need to know i can always reach a Tally support person. this scares me now. seems i should continue trying to pay off high interest rate cards the old-fashioned way. never a late payment.

Signed up for Tally hoping to target two credit cards: 18.99 apr and 21.15 apr, respectively. Tally is covering all of what I owe and my new apr is 11%. That saves me over $7,500.00. THANK YOU.

Great news! I am so happy you’re saving that amount of money! WOWZA!