Updated at 9:23am PST on April 15th, 2020

President Trump signed the Coronavirus Aid, Relief, and Economic Security Act (CARES Act) on Friday March 27th, 2020. This $2 trillion stimulus package is the largest relief bill in the history of the United States, with 9 out of 10 Americans receiving some sort of financial assistance from the government.

The bill will send a one-time direct deposit starting at $1,200 for qualified individuals known as a recovery rebate.

Update: The IRS launched the “Get My Payment” which will allow people to check on the status of their Coronavirus stimulus check. You can also update direct deposit information through this portal.

While the bill helps in so many ways, the focus of this post will be on how it will help individuals only. From how much you will get, when you can expect it, unemployment benefits, mortgage assistance, and a lot more. The post however will not cover anything related to small-business owners or large corporations who will also benefit from the bill.

How Much Will My Coronavirus Check Be?

Remember, you are not actually getting a check in the mail, but rather a direct deposit to whatever banking information the IRS has on file for you.

The amount of cash assistance you will receive from the recovery rebate will be based on your federal taxable income for 2018. However, if you have already filed your 2019 taxes, then the amount you receive will be based on the most current filing.

If You’re Filing Single

For those who are filing single and making $75,000 or less per year, here’s what you can expect:

- Each individual filing single will receive up to $1,200 from the government

- For every child in your household under age 17 (or 16 years or younger), you will receive $500 per child

What if you make more than $75,000?

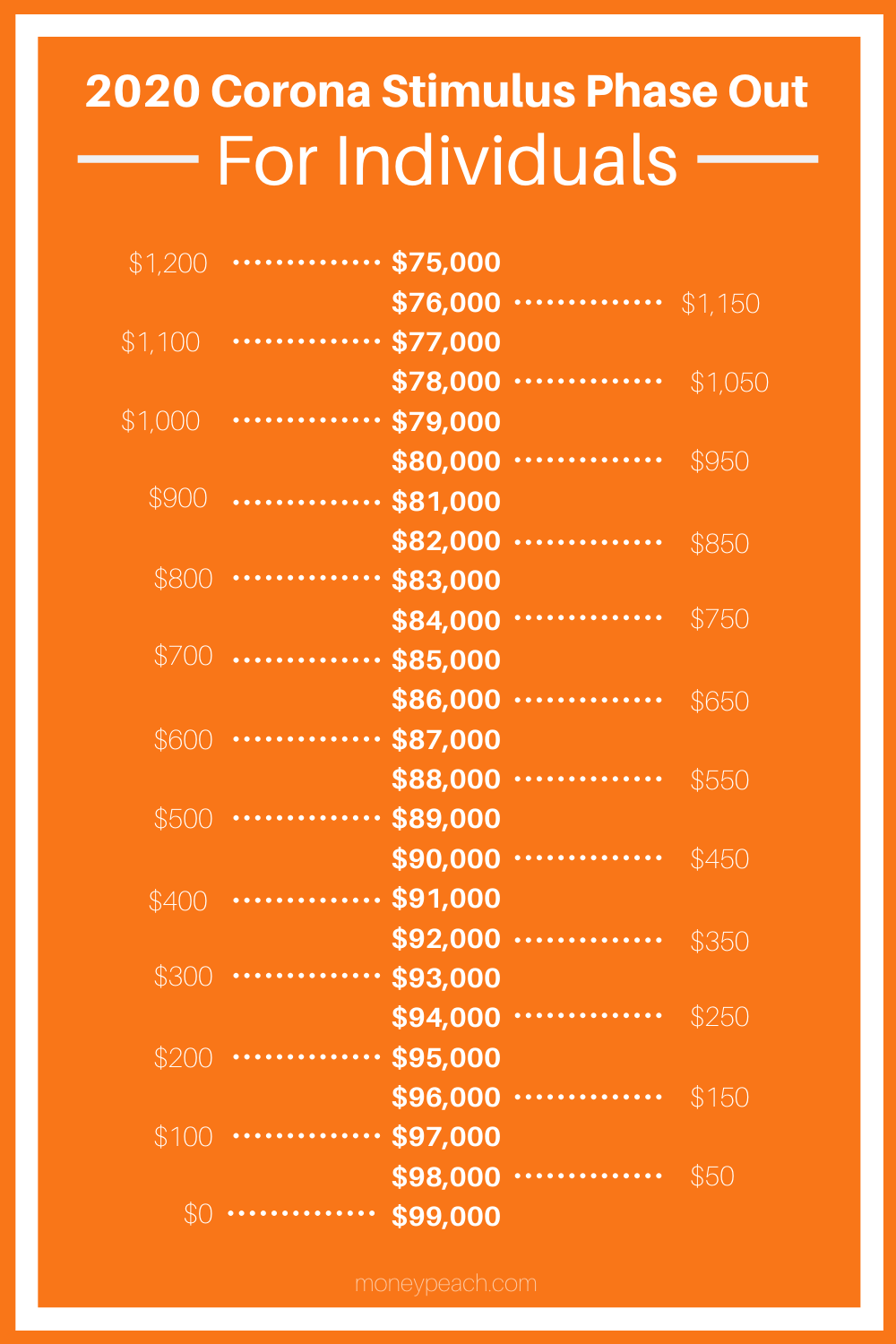

If your income is above $75,000 but less than $99,000, the amount you receive will phase out. If your income goes above $99,000 for filing single, then you will not receive any cash assistance.

The math is pretty simple: for every $100 you earn above $75,000, your cash assistance will drop by $5. For example, if you make $80,000, then you will receive $250 less than the $1,200 — which is $950.

Example: Individuals making $90,000 per year would get $450. ($90,000 – $75,000 = $15,000*0.05=$750, $1,200 – $750 = $450).

Below is what you can expect to receive if your adjusted gross income fell between $75,000 and $99,000. As your income increases from $75,000 to $99,000, the amount you will receive will decrease by 5% for every $1,000 increase in income.

If You’re Filing Jointly

For those who are filing jointly as a couple and making $150,000 or less, you can expect:

- Each couple to receive up to $2,400 cash assistance

- For every child in your household under age 17, you will receive $500 per child

Example: A family of four with children ages 10 and 16 who have an adjusted gross income of $90,000 will receive $3,400 ($2,400 + $500 for each child).

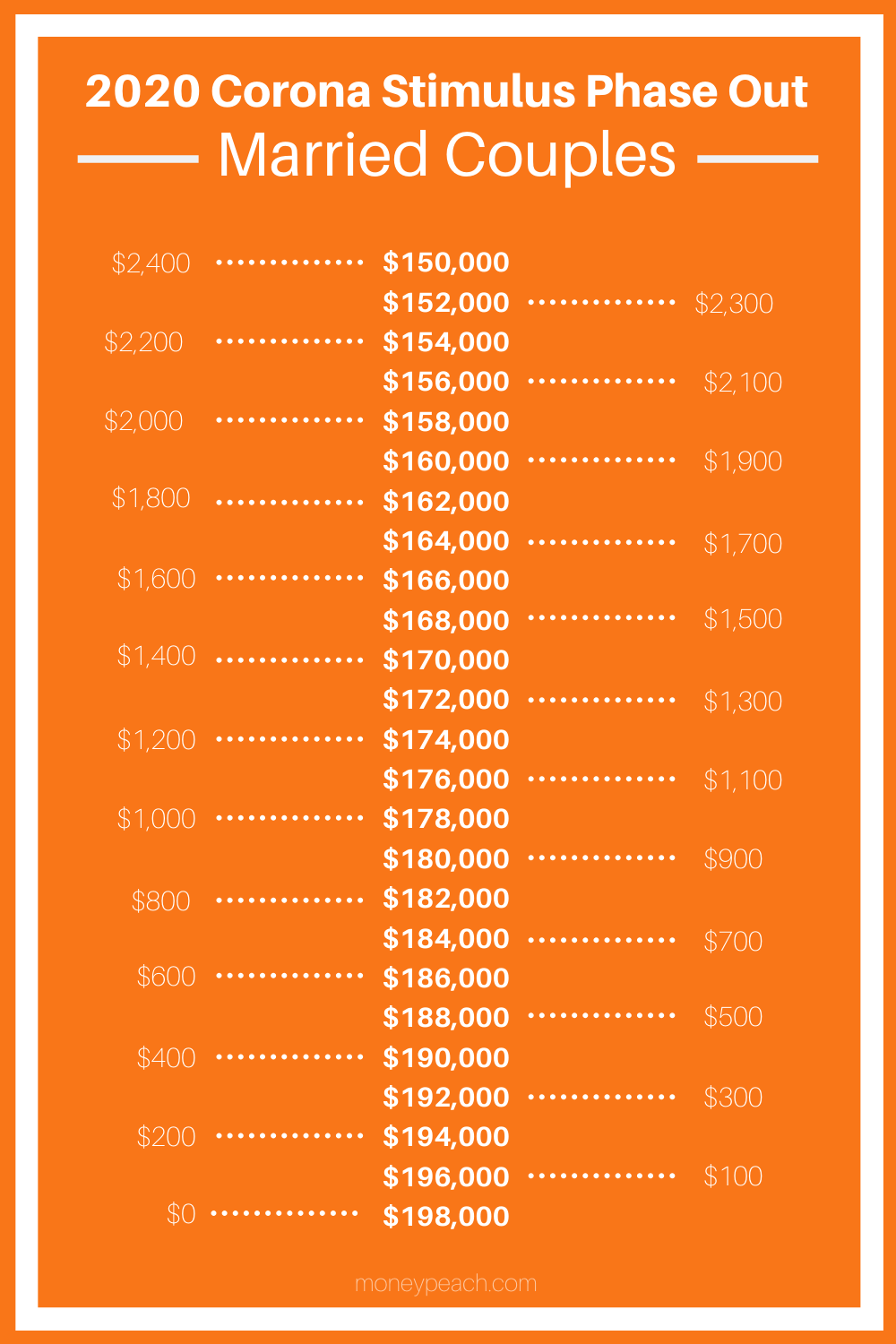

What if you make more than $150,000?

If your total family income is above $150,000 but less than $198,000, the amount of you receive will also phase out. If your adjusted gross income is above $198,000 for married couples, you will not receive any cash assistance.

For every $100 you earn above $150,000, your rebate payment will also drop by $5. For example, if you make $170,000, then you will get $1,000 less than the $2,400 — which is $1,400.

Below shows what you can expect to receive if your adjusted gross income is between $150,000 and $198,000. As your income goes up, the amount you will receive will decrease by 5% for every $1,000 increase in income.

Example: Married couples making $170,000 per year would get $1,400. ($170,000 – $150,000 = $20,000*0.05=$1,000, $2,400 – $1,000 = $1,400).

Note: Incomes are shown in increments of $2,000.

What if I’m Filing as Head of Household?

If you are a single parent or for whatever reason you file as Head of Household — there is good news for you as well.

This increases the phase out amount you would have as a single filer. Instead of phase out amounts between an income of $75,000 and $99,000, those filing head of household start phasing out between $112,500 and $136,500. The same rules apply as for both married and single filers: $5 decrease in recovery rebate for every $100 in income.

$500 for Each Eligible Child

Parents who are filing jointly or as an individual will receive $500 for each child under age 17. To clarify, if your child is 17 they do not qualify. But, if they are age 16 or younger, then they would qualify. The definition of eligible child comes from the Child Tax Credit definition per the IRS.

There is not a limit to how many children will qualify. If you have 2 children under the age of 17, then you would receive $1,000 in addition to the stimulus based on your income. If you have 5 children, then you could expect $2,500 additional assistance.

Note: If your income puts you above the income limits for receiving the stimulus, don’t expect to be eligible to receive $500 per child.

Will Retirees and Those On Social Security Receive Help Too?

Yes. Even for those who don’t file a return because they earn less than the gross income threshold will receive direct deposit from the IRS. The bill states that if no tax return was filed, they will use the information from the Social Security Administration to determine the rebate amount.

This stimulus also applies to those who are on disability.

How Is My Income Determined?

Your income will be based off your Adjusted Gross Income for your 2018 income tax return. However, if you have already filed your 2019 tax return, then it will be based off of your most current return.

It’s an Advanced Tax Credit – What Does This Mean?

Yes, I know this sounds confusing so let’s break it down. First and foremost – you will be getting actual money direct deposited into your account you have on file with the IRS.

Yes, I know this sounds confusing so let’s break it down. First and foremost – you will be getting actual money direct deposited into your account you have on file with the IRS.

The IRS has created a new tax credit that will show up during your 2020 filing (Spring 2021). However, instead of waiting until 2021 to receive the credit, you are now going to get it early — an advanced tax credit.

The question we all have right now is this: when I file my 2020 return (in 2021), will I have to pay back the refund amount if things change and I happen to owe taxes next year?

The answer no. This is a tax credit which means you will NOT have to pay anything back to the IRS.

What if I lost a substantial amount of income in 2019 versus 2018?

This may sound confusing, but remember the stimulus payment is based on your 2020 return, which you will file in 2021. Hence the term “Advanced Tax Credit”.

However, since no one could possibly file a 2020 return yet, your latest tax return (either 2019 or 2018 if you haven’t yet filed) will be used to calculate how much you will receive.

Example: You are single and made $100,000 in 2018 but your income dropped to $70,000 in 2019. If you have already filed your 2019 return earlier the the unknown cutoff date for the stimulus check, then you would receive the $1,200. However, if you have not filed your 2019 return yet (you now have until July 15th, 2020), then you will not receive a stimulus payment this year.

Instead, your stimulus payment — AKA Advanced Tax Credit — will be based off your 2020 income when you file in Spring 2021. Therefore, if your income is lower than $99,000 in tax year 2020, you will receive your stimulus next year.

Will I Pay Taxes on My Stimulus?

Simply put — no, this is NOT taxable income.

Contrary to what many speculated about the government taxing everyone who receives their $1,200, this is not the case.

Where Do I Sign Up?

You don’t because there is no sign up. Payments will be automatically send to those who have filed a tax return or received any Social Security benefits.

How Will the IRS Send Me Money?

The IRS announced they are NOT going to send checks in the mail after all. This means the only way your’e going to get the money is via a direct deposit. Your direct deposit information you have had on file with the IRS with your latest tax filing (2018 or 2019) is where the IRS will be sending your financial relief.

What If Haven’t Filed in the Last Two Years?

If you haven’t filed yet, the IRS recommends you file a simple tax return as soon as possible. This is a very basic return with information like filing status, number of dependents and your bank information where the IRS can send your financial relief.

If you would rather file a simple tax return via the mail, you can fill out form 1040 here. This hasn’t been officially announced yet, but the IRS may be creating a website portal where you can update your direct deposit information online.

Is this Just a One-Time Payment?

For now, yes. However, Speaker Pelosi did say in a statement they could revisit this in the future.

What if I Owe Back Taxes?

So far the bill does not have any language in there excluding you from getting a stimulus if you owe past due taxes. However, I would not be surprised if the IRS does eventually say “no” to those owing back taxes.

Other Notable Benefits For Taxpayers During Covid-19

$600 Per Week Added to Unemployment Benefits

If you are currently filing for unemployment benefits, there is more good news for you.

The bill also adds an additional $600 per week for the next thirteen weeks (four months) in addition to what you will already be receiving from your state’s unemployment benefits. This bill also adds workers usually not covered by unemployment from gig economy workers, furloughed employees and freelancers.

Per the Labor Department, the average weekly unemployment check for February 2020 was $372. Using this average, the unemployment benefit would increase from $372 per week to $972 per week for the next four months.

In addition to the 13 weeks of the additional $600 per week, those still claiming unemployment can extend their unemployment claims for an additional 23 weeks (39 weeks total). See example in the next section below.

“Pandemic Unemployment Assistance”

Those who are self-employed, independent contractors, and other individuals who are unable to work as a direct result of COVID-19 now can claim Pandemic Unemployment Assistance (PUA). Prior to this bill, they were excluded from claiming regular unemployment benefits per state law.

This assistance are only for those who are unable to work for any period of time between January 27 – December 31st 2020 as a result of COVID-19. The maximum duration of unemployment benefits can last up to 39 weeks (10 months).

Example: The average unemployment is $372 per week. With the new stimulus bill, a person who is unemployed will be eligible for $972 ($372 + $600) for 13 weeks and then will receive $372 per week for the next 23 weeks.

Note: Unemployment benefits are still taxable and vary by state.

Emergency Mortgage Relief

Borrowers of any government-backed mortgage (Fannie Mae, Freddie Mac, HUD, VA, and USDA loan) can request a 180 day forbearance from their mortgage company by explaining their hardship due to the Coronavirus emergency. After 180 days the borrower can request an additional 180 days if needed. No additional fees, interest, or penalties can be accrued during this time.

If a borrower is currently facing foreclosure, the bill states that except for a vacant or abandoned property, foreclosure cannot happen for 60 days. This applies to both foreclosure sale or foreclosure related eviction and goes for 60 days from March 18th – May 17th, 2020. You can see more detailed information on mortgage relief during COVID-19 here.

Student Loan Relief

The federal government has set the interest rate on all federal student loans to zero percent for six months. Borrowers can also delay payments without penalty through September 30th, 2020. Interest on the student loan will not accrue any interest for the next six months and your credit will not be negatively affected during this period.

Note: This does NOT apply to private student loans.

To learn more about Student Loan relief, check out the interview with student loan expert Robert Farrington here.

Loosened Restrictions on Health Savings Accounts

Up until the bill passed, you could only use your Health Savings Accounts for qualified medical expenses per the IRS. One of the no-no’s on the list was over-the-counter (OTC) medications if not prescribed by a doctor. That has since changed and you can now use your pre-tax dollars from your HSA for all OTC medications and feminine hygiene products.

Penalty-Free Withdrawal from IRA or 401k

If you tested positive for COVID-19 and facing a financial hardship because of it, you now make up to a $100,000 early withdrawal from their retirement account without paying the 10% penalty to the government. This waives the penalty to anyone age 59 1/2.

Note: These distributions are only for an individual diagnosed with COVID-19 or whose spouse or dependent has been diagnosed or who experiences financial hardships due to the virus.

If you choose to re-contribute those funds back to your retirement account, you will have the next three years to do so. If you don’t repay the amount, then you will have three years to make the tax payments that were due from the withdrawal.

The amount you can borrow from your 401k will also increase from $50,000 to $100,000, and those who are due to pay the loan back in 2020 will get another year to do so.

Lastly, required minimum distributions (RMDs) for those who are age 70 1/2 or older will no longer have to take those distributions for the rest of 2020 which also means they will not be paying taxes on any RMDs as well.

Tax Filing Extension

The Federal Government also extended the deadline to file 2019 income taxes from April 15th to July 15th. This means you will have three more months to file and you will not incur a penalty or accrue any interest on the amount you will owe at filing time.

Still Have Questions?

Ask your question in the comments below and I will get back to you with any credible information I can find. Also, I will continue to update this post over the next few days as more information comes out in regards to the Coronavirus Stimulus Plan.

58 Comments

Any idea how the $500 would work if you are divorced and you claimed your child in 2018, but the other parent gets to claim for 2019 taxes?

Hi Mary,

The stimulus is based off your most recent tax return. If the other parent claimed the child in 2019 and has already filed, then they would receive the $500 for the child under age 17.

It seems crazy that as multimillionaires my wife and I will be getting $2,400, but having paid a boatload more taxes than most people I’ll take it. We won’t spend it of course, we didn’t gain our wealth by spending more when extra income came our way. We got where we are by saving and investing extra money as our income grew.

Hi Steve,

Thanks for sharing. Yes, if your adjusted gross income is less than $150,000 then you will be receiving a check for $2,400. You also sound like the Millionaire Next Door – well done!

How about student loan … they took all of our refund end of feburary are they going to be refunding us or is it just after marxh 13th!!

Hi Vanessa – I don’t quite understand your question, but I can say the Coronavirus Stimulus Check is independent of your tax refund from this year. If you were owed a refund or you owed the IRS, you will still be getting a stimulus check.

What about child over 18 that attends college full time? He is claimed on parents tax return

Hi Tracey,

He would not be eligible to claim the benefit if you have already claimed him on your tax return. Also, the bill uses the definition from the child tax credit which means an eligible child (to receive $500 per child) is under age 17 – or age 16 and under.

Hi. I claimed HOH in 2018 claiming 4 of my 5 children. I have not yet filed 2019 returns however my ex has and he claimed 2 kids for 2019. I have majority time with children the exchange of children as a tax exemption is merely a negotiation tactic within our agreement to allow my ex the tax write off since he pays child support. So for the additional $500 who gets it?

Hi Sheena, unfortunately for you it sounds like you will not be eligible to collect the $500 per child since your your ex already claimed them on his return for 2019. However, if you can claim the other 2 children on your return when you file and you are below the income limits, then yes, you would receive $500 per child.

I’m retired and my wife is disabled, that’s our income. Do we qualify for the relief checks

Great question Robert and the answer is yes – those who are collecting SSI benefits will still get relief checks.

Okay, I’m on Social Security Disability and do not have to file taxes. Am I going to have to file my taxes before I will receive my check? Also will my check still be for the full $1200? I make less than $14k per year, single person.

Good news Angela, you will be getting a check for $1,200. The bill does not have a low income cutoff and even if you don’t file your taxes, you are on record with the Social Security Administration and your check will be sent the same way your disability comes in.

My son is a 21 year old student. Is he eligible for the stimulus payment?

Thanks!

Hi Jeff, if you have claimed your son on your return, then unfortunately he would not be eligible for the stimulus payment.

I claim a working full time college student. Will she get money or will I get $500 fir her? She is 21.

Unfortunately anyone who is claimed under someone else’s taxes will not receive a stimulus check.

I’m an LLC and the only employee. Am I eligible for un employment here in AZ?

Hi Vickie – I know in AZ that if you’re a sole employee of your own LLC (I am assuming you’re an LLC filing as an S-Corp) then you are not required to pay unemployment tax. This is a benefit to you on the tax side, however if you’re not paying into FUTA, then you will not be eligible for unemployment. Basically, if you are the employer and the employee, and you don’t pay unemployment taxes, you will not receive unemployment.

UPDATE I just updated the post to include the Pandemic Unemployment Assistance (PUA). This includes all of those who are self-employed, independent contractors, and other individuals who are unable to work as a direct result of COVID-19. Scroll up for details inside the post.

If you just started working (1/2020) so you don’t file until next year, and been a “stay at home parent” so you have not filed in many years. Do you qualify? (There is no tax return, since 2012, to base income from)

Tina, are you claimed under someone else or is there someone in your household filing a return each year?

Ref stimulus checks, I understand that it is not taxable income, however can you find out if it will be included in the MAGI calculation for ACA determination purposes?

Hi Mark – I have looked through it all and I don’t see anything saying whether it would or would not affect your MAGI. This is just me speculating, but I would think “no” since you’re not actually applying for this stimulus.

If a 1099 consultant will qualify for this expanded unemployment insurance (gig worker?), how will it be determined, given that income and working was very intermittent last year and has been nothing so far this year?

Hey Mark – I just updated the post after your comment. Here is what we do know now: There is now Pandemic Unemployment Assistance which extends to self-employed, freelancers, gig-workers and the like. This gives unemployment benefits to those who normally wouldn’t qualify and extends those benefits. Details are above, but the big news it extends unemployment for up to 39 weeks, with 13 of those weeks allowing you an additional $600 per week on top of your state’s unemployment benefit.

My son graduated college in May of 2019 and it is the last year we claimed him as a dependent. For the 2020 return he will be independent. Will that all be figured out when he files 2020 taxes (spring 2021) so he qualifies since this is happening in 2020?

That is a great question Mary and as of right now I am not entirely sure. I want to say “yes” since there is a provision that states if you are owed more because you delayed your 2019 filing, then you would see that amount you were entitled to in Spring of 2021. Again, this is merely just speculation and I wish I knew the answer. As soon as I do know, I will post it here.

Do you know what the reasoning was for blocking the age of children to under 17?

17-year-olds and college students claimed as dependents still need to eat and still have basic needs. Why aren’t their needs being thought of? Parents are still providing for them..,,

I wish I knew the answer to the “why” behind the age. I do know the bill uses the Child Tax Credit definition. I don’t disagree with you at all. It does seem like age 17 and up who also claimed on someone else’s return are getting the short end of the stick.

Hi Chris,

My mother receives my late fathers SS benefits. She’s been a lifetime homemaker and never had income. Does she qualify for the stimulus check?

Thank you for answering all these questions. I couldn’t read over 800 pages on that bill lol

Yes Liz, your mother would still get $1,200. The money would either be sent to where her Social Security payment goes each month or via a check in the mail.

I do not understand the Direct Deposit from the IRS. We never get a return, we always owe them because my Husband is a Contractor and I collect Social Security. How will we get a check?

If you collect Social Security via direct deposit, then the check will be automatically deposited into that same account. If you usually get a check in the mail, then this is how you will receive your stimulus check. Great question Shelley!

My daughter is 20 years old and is enrolled in college. We claimed her as a dependent but she filed her own 1040 form because she works while away at college. Will she get a check?

Unfortunately she will not because you claimed her as a dependent. Sorry about that Angie.

Right now I’m raising my grandson he is four and I am his grandmother and I am on social security disability would I get anything for him and I have half custody of him

Maureen, if you are claiming your grandson on your tax filing and he is age 16 or younger, then you would receive $500 for him in addition to the $1,200. If you don’t file since you’re on disability, then yes on the $1,200 but not 100% sure about the $500 if no one is claiming your grandson.

I am making considerably more money this year than last. I don’t mean to be greedy,( but I am a teacher…) If I haven’t filed my taxes yet this year, and I’d like them to base my check on my files from last year, how long should I wait before I file this year’s(2019) taxes?

You have until July 15, 2020 to file your 2019 taxes. If you want to play it safe, I would wait so your 2018 taxes are what your stimulus is based from.

What if someone has not filed their taxes for 2018 or 2019?

If someone hasn’t filed in the past 2 years (2019 or 2018) for reasons they collect Social Security or because their income fell below the yearly deduction, they will still be receiving $1,200.

My son is 38 tears old and lives with me full time. He is my caregiver and has never held an outside job nor filed taxes. We both live on my Social Security check. I know I am eligible for the stimulus money but since he has never filed will he still receive a check?

Hi Ramona,

Great question. The only way for the government to know whether or not you are going to get issued a check is if they 1) have filed a return within the last two years or 2) receive social security benefits. If your son does not fall within those two guidelines then it’s highly unlikely he will receive a stimulus check in addition to you. I wish I had better news for you, but it doesn’t sound like he will be receiving a stimulus check.

I am filling for disability and haven’t worked since 2017, my husband is disabled and receives ssdi, so we have not filed taxes for the last 2 years. I understand that he will get a check, but will I?

Hi Christy, if you haven’t filed and haven’t received any benefits from disability of SSI yet in the past, then there you most likely will not be receiving anything. However, if your husband is receiving anything via disability benefits, then you can expect to see the $1,200 go into the same account your husband receives for his disability assistance.

What if in 2018 you done direct deposit but in 2019 you did hr block debit card which way would you get it?

Whatever the IRS has on file for you for direct deposit will be how you receive the CARES Act rebate Susan 🙂

Will we have to pay back any of the stimulus money – or will it be taxed as income?

Good news Amy! This is NOT taxable income and you will NOT have to pay any of it back.

Hi Chris,

What if someone owes back child support? Will they get the $1200 or would it go to the other parent?

Hi Judi,

It sounds like even if you do owe back child support (or even back taxes for that matter) that you would still be receiving the $1,200 from the CARES Act.

I am a single parent who filed HOH my daughter is now 20 working 2 jobs and going to college but lives with me so I was able to claim HOH. She filed and paid taxes, will she also receive a check?

Hi Amy, if you claimed your daughter as a dependent on your last filing, then she will not be receiving money from the CARES Act. Basically, anyone who is claimed as someone else’s dependent will not be getting assistance. Sorry about that 🙁

The IRS does not have bank routing numbers for us since we always have had to pay more in one the Federal level. We do, however, get a small state return which is direct deposited. Will we get a check by mail? If so, timelines on that?

Hi Cindy, the IRS stated back on March 30th that it’s website would build a portal where people can update their information “in the coming weeks.” That’s all we know for now, but as soon as something is updated, I will post it here.

i am head of household and in 2018 sold stocks which put me at a higher bracket and got 10 dollars stimulus check. 2019 was less than 75k and was filed in April 2020 which is still in process. would I get the full stimulus check (prorate)? do i get the full amount for the last stimulus? or they are still going to calculated from my 2018 tax return? thanks