You either love them or you hate them, but the fact remains that they are a major part of the present world. Buy now and pay later has become the motto for modern-day culture, thanks in part to that little piece of plastic 7 out of 10 people carry with them at all times.

Credit Cards. They are what they are.

Fast forward only a few years and I failed at simple 5th grade math. I was part of the majority of Americans who carried a balance, paid 24.99% interest at all times, and made only the minimum payment.

Don’t worry Mom & Dad, I am just building my FICO score!

A few years later, we were successful in racking up $52k of debt and ended up going broke in a blink of an eye. Was it the credit cards fault? Hell no! Was it the bank’s fault? Absolutely not. It was simple: I sucked at using credit cards.

I am right on the edge of being a Millennial (1983), and for most of us it is almost impossible to even imagine life without the Internet, The Simpsons, Starbucks, and you guessed it- the credit card.

I have always said that we lack financial literacy education as a entire society (not just Millennials), and that includes learning about how this whole credit card thing was started. Credit cards are a way of life for most people today. Don’t believe me?

The Fun Facts

- 72% of adults have a credit card

- 37% of College Students has a credit card

- There are enough credit cards to span the Earth 3.5 times

- Credit card companies spend roughly $80 to acquire you as their customer and on average that customer returns $120/year to the credit card company

- Credit card interest rates are actually illegal in most states (most states don’t allow the high interest rates that credit cards charge at a state level, however the Marquette Ruling allows for credit card companies to offer high interest rates across state lines, just as long as the bank is located in the state without the interest rate cap. This is why you’re credit card processing center is located in either South Dakota, Nevada, or Delaware).

- The average person using a credit card carries 3.7 credit cards in their wallet

- As of December 2018 there was $1.04 Trillion of Outstanding Credit Card Debt

- The average credit debt in 2018 is $5,331

The Credit Card Timeline

So, how did we get here?

I’m glad you asked ??

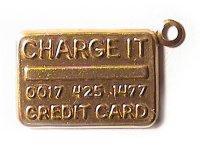

1946 – The Charge-it Card

John Biggins, a banker from Brooklyn, NY, came up with the idea of the “Charge-it” card. This card allowed a consumer to pay a merchant by using the card. The merchant would then take the sales slip to Biggins’ bank and the bank would collect payment from the consumer. However, the “Charge-it” card could only be used locally in Brooklyn and the customer had to be a member of John Biggins’ bank.

John Biggins, a banker from Brooklyn, NY, came up with the idea of the “Charge-it” card. This card allowed a consumer to pay a merchant by using the card. The merchant would then take the sales slip to Biggins’ bank and the bank would collect payment from the consumer. However, the “Charge-it” card could only be used locally in Brooklyn and the customer had to be a member of John Biggins’ bank.

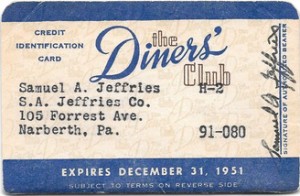

1950 – Grab a Meal with the Diners Club Card

Frank McNamara is having dinner at a restaurant in NYC and realizes he forgot his wallet when the bill comes. He comes up with an idea for a closed loop system where consumers could use a form of a credit card to pay the restaurant, the restaurant would then invoice the bank, and the bank would collect payment from the consumer at the end of the month. He named it the “Diners Club Card” and it was solely used for upscale restaurants inside NYC. The card was made of cardboard in the initial days and soon moved to a celluloid paper base. However, poor Frank thought his idea was just a fad, and sold his idea for a whopping $200k, or equivalent to $1.6 million in today’s dollars. Oops.

Frank McNamara is having dinner at a restaurant in NYC and realizes he forgot his wallet when the bill comes. He comes up with an idea for a closed loop system where consumers could use a form of a credit card to pay the restaurant, the restaurant would then invoice the bank, and the bank would collect payment from the consumer at the end of the month. He named it the “Diners Club Card” and it was solely used for upscale restaurants inside NYC. The card was made of cardboard in the initial days and soon moved to a celluloid paper base. However, poor Frank thought his idea was just a fad, and sold his idea for a whopping $200k, or equivalent to $1.6 million in today’s dollars. Oops.

1951 – The First Bank Credit Card

New York’s Franklin National Bank issues the first actual Bank Credit Card. This credit card allowed only it’s account holders to use the credit card with merchants who had partnered with the bank, still limiting where the credit card would actually be accepted.

1955 – Diners Club Still Leads the Way

The Diners Club Card grows to 200,000 members and branches out to restaurants and others services in more than a dozen countries. Frank McNamara, the creator of the Diner Club Card, no longer holds the rights to the card and doesn’t enjoy it’s growth from local only to an internationally used product.

1958 – Introducing the American Express Purple Card

American Express joins the credit card industry with their Purple Charge Card that was solely used for travel and entertainment purposes. They were also the first to move to a plastic card, similar to what we have today.

1958 – Bank of America creates the BankAmericard

A California bank called “Bank of America” launches its first revolving credit card product to consumers and labels it the BankAmericard. This product was launched in Fresno, CA and 60,000 unsolicited offers were sent out through the mail to the people of Fresno. This would be the first time ever unsolicited credit card offers are “dropped” into the mailboxes like they still are today. In 1976, BankAmericard would later become known as VISA.

1966 – “For Everything Else, there’s MasterCharge”

Up until this point, each bank would have to issue their own credit card to their consumers. Multiple California banks decided to work together and formed the Interbank Card Association (ICA). This allowed multiple banks to transfer funds and work together in an “open-loop” system, versus the closed loop of the earlier days. ICA later changed their name to MasterCharge, and then became what we know them as today: MasterCard.

1970 – The Magnetic Strip

American Express issues the first credit card with the magnetic strip. Although the technology was available, it wasn’t widely used until a decade later in 1980 when VISA and MasterCard both added magnetic strips to their cards. The magnetic strip would take the account holder’s information, contact the bank to determine sufficient funds were available, and report back an “Approved” or “Declined” status all within a few seconds.

1973 – The Speed of Technology

Credit cards finally become automated. Before this time, the merchant would have to contact the bank, the bank would have an employee look up the record of the account holder, and then the bank would notify the merchant if the employee had available credit. This process would often take up to 5 minutes, however the use of automation sped this up to less than 1 minute per transaction. Today, the transactions are almost instantaneous.

1976 – “VISA…It’s Everywhere You Want to Be”

After Bank of America gave up full control of the the BankAmericard card to other banks across the world, it became apparent that the need for a open-loop system similar to their competitor MasterCard. The BankAmericard group formed the name, VISA.

1986 – DISCOVER a new kind of Credit Card

Sears realizes they can increase profits by selling more than “stuff” inside their stores and launches it’s own credit card program. Their credit card would soon be called the Discover Card. They are also the first to offer a “cash back” rewards program. The very first ad glimpse of Discover Card appearedin this Superbowl XXI commerical below.

Watch the Commercial

1987 – American Express Gives In

American Express offers up their first credit card product where you don’t have to pay it off on full, joining the other credit card issuers around the world offering revolving debt.

1989 – Free Airline Miles

Citi Bank partners with American Airlines to offer the first Credit Card Travel Rewards Program. This opens up the floodgates to an era of the credit card rewards program. People are now using their credit cards for two reasons: to buy stuff they cannot afford and earn the free airline miles. However, Consumer Reports estimate that only 22% of the credit card airline miles are ever redeemed.

2004 – Would You Like to SuperSize that Swipe?

Credit cards become widely accepted at McDonalds, and other fast-food restaurants soon follow suit. The following year it is estimated that American families spend $420 million per week on fast food using their credit cards. Ironically, McDonalds reports back that people will spend 47% more at their restaurants when using plastic versus cash.

2014 – security…..SECURITY!

The United States starts accepting the “smart card”, which is a tiny circuit board inside the credit card that holds all the same information as the magnetic stripe. The main difference is the chip has a “rolling code”, meaning the data is scrambled after each use, thus making it much more secure.

The Future of Credit Cards

Many believe our smartphones will actually replace the credit cards that have been carried inside our wallets since 1946. Others believe that our biometric thumbprints may be used as our form of payment instead of the soon-to-be outdated credit card. Whatever it may be, I think we can all agree that credit cards have come a long way from the initial pieces of cardboard that could only be used locally and through one single bank in Brooklyn.

Money Peach on Credit Cards

After paying off our $52k of debt in 2011, creating a fully funded emergency fund, and building wealth, we decided we would go through life without a credit card…and we did this for 7 years. Yes, 7 years without a credit card (and we actually survived)!

Today, we do use credit cards but we use them just like a debit card – we NEVER carry a balance. We do this by setting up our credit cards to pay the balance in full automatically. We simply make a purchase on our credit card and then we enter that expense into our monthly budget.

Easy Peasy!

If you Like it, Please Share It!

As always, I first want to thank you for reading this blog because this means you are reaching for awesome with your money! I will keep putting content out there for anyone to gobble up and implement right away, however if you could help me out by sharing this post on your favorite social media platforms, it would mean the world to me! Just click on any of the social share buttons at the top or bottom of this post and you’ll be giving me a virtual fist bump, high-five, and a pat on the back. Thank you again and again!

-Chris Peach

12 Comments

I actually didn’t know a few of these facts about the history of credit cards. Interesting!

Hi Cat,

I’m a pretty big nerd when it comes to money facts!

As you say, credit cards aren’t inherently evil. But as you discovered, some people are simply not cut out to own a credit card–inevitably leads to financial trouble. Because having no credit card can be a problem, maybe those who’ve learned they’re not good with credit cards should opt to have just one card with a low limit like $1,000 or $2,000. What do you think?

This was a very interesting post – if a “financial literacy” class actually existed, it should be required reading 🙂

I 100% agree!

Hi! Good article, and I enjoyed seeing the old cards. Question for you – my husband and I are considering trying a one-month credit card ban, but we have a couple of logistic questions and I’m hoping you don’t mind me asking them of you. Do you not order online, or do use some other way? After having our debit card info stolen 5 times over the last 15 years, we’re hesitant to use anything other than a credit card. Do you use debit cards for purchasing plane tickets, or for other retailers who will only do auto payments to credit cards (like our daycare facility)?

Hi Christina,

We haven’t had a credit card since 2011 and we use our debit card just like would a credit card 🙂

Fascinating history, and great research! Totally sharing this on Facebook. It’s hard to believe that revolving credit didn’t exist before the late 80s, and it’s interesting that this invention has coincided with the stagnation of most Americans’ real wages over the past 20-30 years.

As I was doing the research, I had the same thoughts. When you dig deeper into the research, you will see there were a few key things that were passed into legislation which relaxed many of the lending laws across state lines. When that happened, the flood gates were opened to the world of revolving debt, high interest rates, and mailboxes filling up quickly with credit card offers.

Hello,

Curious if you have come across any case studies on the marketing/strategy side for Bank of America in creating the BankAmericard.

I know they launched their first revolving credit card product to consumers and labels it the BankAmericard. They launched in Fresno, CA and 60,000 unsolicited offers were sent out through the mail to the people of Fresno. This was the first time ever unsolicited credit card offers were “dropped” into the mailboxes like they still are today. In 1976, BankAmericard became known as VISA.

How did they create mass adoption acceptance? They had been using cash and this was completely foreign to them. How did they gain the trust of the people?

I don’t know about case studies, but if you do a little reading about VISA, formerly Bank America, you will find that they gave up control of everything in the seventies. This allowed it to be marketed internationally. That’s also about the time the name changed. I think that could be part of it, along with continued marketing efforts and other improvements.

Thanks for the enlightenment. The information is so helpful.