Let me guess — someone asked you to write a check and you said “okay”, but then you asked yourself, how do I fill out a check?

I’ll agree with you that writing a paper check is definitely an old-school way of sending and receiving money. Especially now with all the ways of sending money through our mobile apps, filling out a check seems a little archaic.

However, just like everyone probaby at least know how to drive a stick shift, you should also know how to fill out a check.

And if you think checks are obsolete, think again. A report done by the Federal Reserve reveals that there were 14.5 billion check payments in 2018!

With that said, let’s learn how to fill out a check.

How to Fill Out a Check in 6 Steps

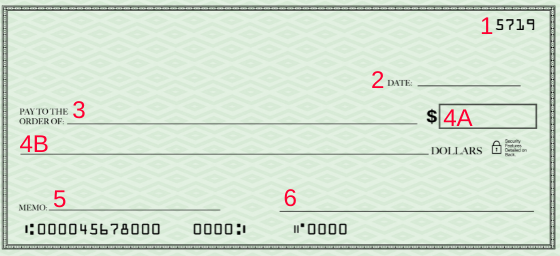

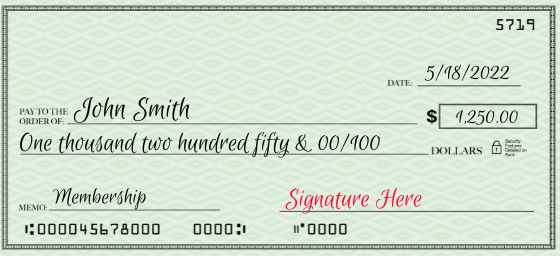

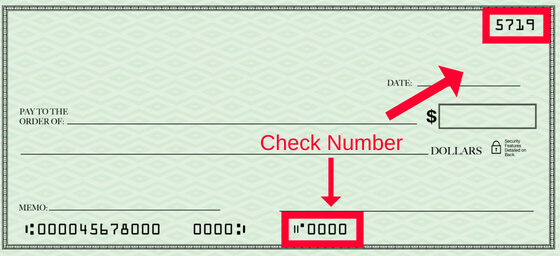

As you can see in the image above, we have labeld numbers one through six when it comes to filling out a check. Let’s get started with the very first step when it comes to filling out a check.

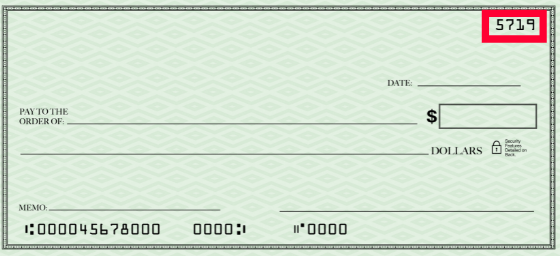

Step 1: Note The Check Number

To balance your checkbook and also make sure you didn’t misplace any checks, it’s important to notate the check number.

The check number is in the upper right hand corner of the check and usually the bottom right as well.

Most people don’t write this down but it can be a huge pain if something happens after you give the check away.

If you need to stop payment or want to track the check you will need to know the check number. Plus, when you reorder checks, you’ll want to know which number to start off with so you don’t duplicate previous checks you’ve written.

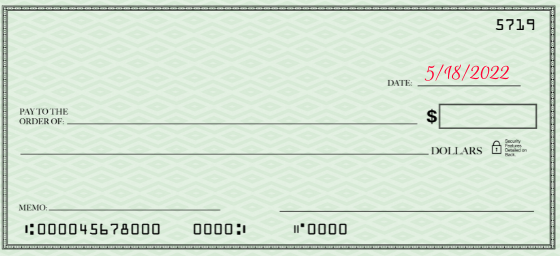

Step 2: Date The Check (Correctly)

The second step to learn how to fill out a check is to ensure that you date the check.

The date section is also found in the upper right hand corner of the check. Make sure to write the full date out next to or above the word DATE.

Any format works for the date as well. You could write it out as:

- 5/18/22

- May 18th, 2022

- 18/5/22

I recommend that you always make the date of each check the same structure for your own benefit. In case you have fraud it will be easy to figure out who wrote the date in a different style.

One of the biggest mistakes people make when filling out a check is forgetting the date or marking the wrong date.

This is a common mistake in January as people still mark the prior year. Plus, if you accidentally put a future date your recipient won’t be able to cash the check until then. This can be extremely frustrating for both parties.

But, if you have spoken with the recipient you can choose to post date the check for a future date. This is a good idea if you’re waiting for money to be deposited into your account on a specific date.

This ensures you won’t have any overdraw or declined check transaction fees. It also gives the recipient piece of mind you intend to pay as they already have a signed check in their possession.

Note: If this is something you plan on doing be sure to alert the recipient in advance.

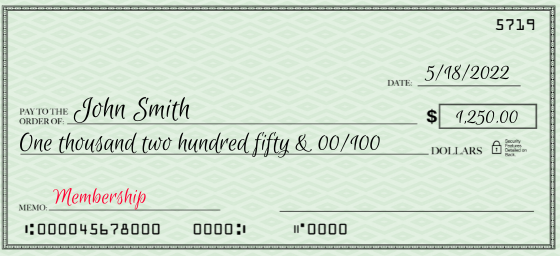

Step 3: Write Out the Name of the Recipient

Next up, you will need to write out the name of the person or business you are paying (also known as the recipient).

Below the date you will see the main line which says, “Pay to the order of” or simply “Pay to.”

If you are writing the check to one person, several people, or a company you can write all the details here. The most important part about this step is ensuring that your handwriting is legible and that you spell the name (or names) correctly.

Some banks will not accept the check if it is misspelled and even have an additional fee for the inconvenience.

Before you fill out the check make sure you clarify with the recipient how to spell the name and/or business organization. If you are writing to a person clarify their full name as some people go by shortened versions or nicknames.

If you are writing a check to a business, ensure if they have any abbreviations after the business name like LLC.

Also, you can address the check simply to “cash.” Only do this if you know who the person is.

Important! Once you write out “cash” anyone that finds the check would be able to cash it.

Step 4: Write the Correct Dollar Amount

Once you’ve notated the check number and filled out the date and the recipient, you need to write out the exact dollar amount.

This will be done two different ways; both with numbers and words.

4a. Write Out The Dollar Amount in Numbers

To the right of the “pay to” line there will be a box and dollar sign where you write in the amount. If you are paying $1,250 you will simply write 1,250 next to the dollar sign ($). If your dollar amount includes change you need to notate this properly as well. Make sure to use commas and periods as needed.

4b. Write Out The Dollar Amount in Words

This seems to be the part that most people mess up when filling out a check.

After you’ve written out the amount in numbers you need to communicate this with words as well. This ensures there are no mistakes on the total amount of the check.

Below the “pay to” line there will be another blank line to write out the dollar amount.

If the total amount is $1,250 you would write out, “One thousand two hundred fifty.”

A good rule of thumb to remember is to say the amount out loud. You also have the option to hyphenate between each word or choose not too. This is entirely at your discretion.

Another area where people tend to get it wrong is only having the partial dollar amount. For example, if your amount was $1,250.75 you would write out “One thousand two hundred fifty” and then put the amount as a fraction (75/100).

One thousand two hundred fifty dollars and 75/100.

It might help to think of partial dollar amounts as percentages. Never write the words “cents” on your check as it is already implied by the format of X/100.

To avoid any confusion make sure you write this amount in smaller numbers above the main payment amount.

Step 5: Write What the Check is For

Now that the hardest part is over you only have a few steps left.

Next, in the lower left-hand side of the check, you can write out what the check is payment for. This isn’t necessary to fill out but can give you more of an idea for your own personal tracking.

For example, if you were paying for your membership you could write in, “July, Membership Fees.”

If you are writing this check in-person, make sure to ask the recipient if they want it left blank. Some establishments will write in your membership number, last four of your SSN, or some other system that they use internally.

Step 6 (Final Step): Sign the Check

YOU MUST SIGN THE CHECK!

The line is in the lower right-hand corner of the check is for YOUR signature. All you need to do is sign your name next to the word SIGNATURE.

While this is a relatively simple step, it is also one of the most common errors. If you forget to sign the check this completely voids the entire process.

If you don’t sign the check then the financial institutions will not be able to process it, and this goes for mobile deposits as well.

This is a huge pain if you physically send the check off and the recipient can’t cash it.

Make sure you always sign the check. Don’t worry much about signature as it’s more of a formality than something they evaluate too closely.

Congrats, you know how to fill out a check!

Once you get in the habit of filling out a check it will become second nature to you. While the steps are straightforward there are tons of frequently asked questions you might encounter.

12 Most FAQ’s About Filling Out a Check

1. Can I write a check to myself?

Yes, you can write a check to yourself.

Sometimes this is a great idea if you have several banks and don’t want to worry about ATM fees or wire transfers. In this case, you would write “cash” or your name on the “pay to” line.

Be sure to check with your bank to see which option they prefer. You would then sign the back of the check as the endorser as well.

I would recommend only doing this if you are already physically in the bank or ready to make a mobile deposit right away.

Rember, if you make the check out to cash and then lose it, then anyone who has the check can cash it right away.

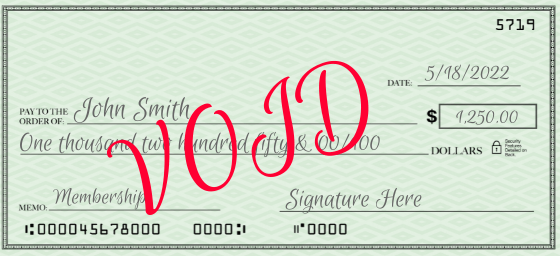

2. How do I void a check?

Voiding a check is super easy.

To void a check simply write VOID in large letters across the check. Other people will write “VOID” over the date, pay to, memo, signature, and dollar amount fields. Either way works.

To play it safe I recommending destroying the check just in case something happens. I would also notate this in your checkbook so you don’t think you misplaced one blank check.

3. Can I write a check with a pencil?

You can, but don’t do it.

There isn’t an official policy when it comes to pen or pencil, however I will tell you this: NEVER write a check in pencil. You are much better off writing the check in pen so it cannot be altered.

Also, NEVER use red ink because it shows up as blank in the bank’s computer system and is then automatically sent to the fraud unit. Only use blue or black ink.

Also, avoid thick sharpies and similar pens as they can bleed through to the back of the check. This might make it hard for the recipient if they are using mobile app deposits.

4. Should I write on the back of the check?

Not if you are the one cutting the check. You will only sign the back of the check if someone is paying you for something. If this is the case make sure you sign legibly by the X and nothing more.

There is usually a “Do Not Write Below This Line” and is generally used for banking purposes. Make sure to not write out your name or anything else in this space.

Depending on your banking institution, you might need to write something if you are depositing the check from your mobile app. Again, this is very rare and might void the check. Be sure to follow instructions with your banking institution.

5. What if I make a mistake when filling out the check?

If you make an error on the check don’t panic. I would avoid crossing things out as that might look like you are voiding the check and instead, try to write over it.

Remember that if you misspell the name by something small you should be fine.

6. Can I postdate a check?

Yes, you can postdate a check if needed.

As I mentioned in Step 2, the person with the check will not be able to cash the check until the future date. It is a good idea if you waiting for sufficient funds to hit your bank account.

Again, make sure you speak with the recipient as it can be awkward if they try to cash it before the correct date. Plus, there is no guarantee that the bank doesn’t cash it sooner. Even with technology, people still make mistakes including cashing checks earlier than intended.

If this happens you might be hit with overdraft fees as well. Play it safe and wait until you have sufficient funds in your account instead of postdating.

7. What are the most common mistakes when writing a check?

You’re human, mistakes happen. Especially when it comes to filling out a check as it is such a rare occurrence these days.

The most common errors include:

- Forgetting to sign the check. Remember if you forget to sign the check it is invalid until you have signed.

- Dollar fields don’t match. As I outlined in Step 4, you need to write out in words and dollar amount. If these fields don’t match banks may decline them.

- Writing the wrong date. This happens frequently after New Year’s as people forget it’s a new year.

- Accidentally signing the back of the check. You might forget that you wrote the check and signing it will instantly void it.

8. Is a personal check a certified check?

No, a personal check is NOT a certified check.

A certified check is done by computer and filled out at the bank. In the rare instance I ever need a check I choose to do this because I personally don’t like spending money ordering new checks.

The main difference with a certified check is that you need to ensure you have sufficient funds the day the check is dated. Otherwise, the bank will not cut the check.

With commercial checks, they immediately withdraw the funds from your bank. Be careful with these as you can’t void them like a normal personal check.

A certified check is usually needed for specific purchases and loans. For example, when I bought a house I needed to bring the earnest money as a certified check.

This could also happen if you are buying something more expensive like a car. Even random transactions like paying for a passport may need a certified check.

9. Can I write more than one name on a check?

Yes, you can write several names on a check but there is a catch.

For example, let’s say you are writing a check to Tony and Jane Smith for their wedding. If you write next to the pay to “Tony Smith and Jane Smith” they will both have to endorse the check. It won’t be valid if only one or other signs the back to deposit or cash.

A better option is to use the word “or.” Write out “Tony Smith or Jane Smith” and only one of them will need to endorse the check.

10. Why do I need to write numbers as words on my checks?

This is a great question!

As you remember, you write out the total dollar amount in both words and with numbers. However, the dollar amount written in numbers is known as a courtesy amount, but the written words are actually the legal amount owed.

If there was ever a legal dispute you would be required to pay what is written in words over the numerical amount. They are small details but they could cost you big time. Make sure you write out the exact amount in both words and numbers.

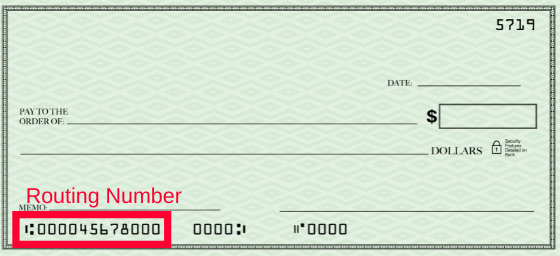

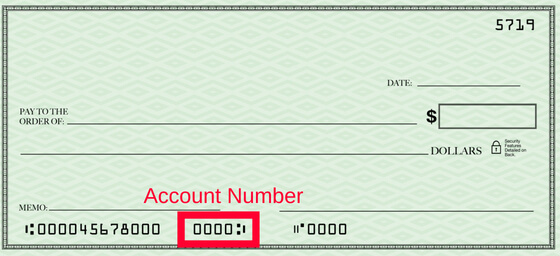

11. What do all the numbers on my check mean?

On the bottom of your checks you should see three distinct numbers:

- Routing number. This is the nine-digit number on the bottom left side of the check and is specific to your bank. You can think of it as your bank’s personal identification number and is only unique to your bank or credit union. If you are signing up for direct deposit you would include this and your account number.

- Bank account number. This is the specific number to identify the actual checking or savings account assigned to you at the bank or credit union. This appears in the bottom-middle of the check.

- Check number. This is usually a 4 digit number that comes after your account number and is also found in the top right-hand section of the check. It’s a good idea to notate the check number in your checkbook in case any future disputes occur.

Note: In the above example, the last four at the bottom of the check would also match the 5719 at the top right corner of the check.

Make sure that you do not write over any of these numbers or cover them in any way.

12. Does it really matter if I write the check correctly?

Yes, for several reasons. First, if you don’t fill out a check correctly the other bank can choose to not accept the check.

Not only will the recipient be frustrated but you might have to pay fees for your error.

Returned check fees aren’t cheap either! Similar to overdrawing a debit card, these fees can range between $15-$40 depending on your institution.

Take the extra few minutes to make sure you filled out everything properly and don’t’ waste money on something silly.

13. What are some good alternatives to writing checks?

Today, there are a ton of great ways to send money via your mobile app. From Zelle to Venmo and The Cash App to PayPal, you can quickly and easily send money in lieu of writing a check in a matter of seconds.

Final Thoughts

Only write a check if you absolutely have to.

Unfortunately checks are becoming less used over time as our banking needs rely more on technology and mobile banking versus walking into a bank and cashing a check.

However, it’s still a good skill to have because when all else fails, you can still write a check at the end of the day.