Have you ever wondered how to start a budget? Do you ever feel like you’re living paycheck-to-paycheck?

Don’t feel bad because you’re definitely not alone. In fact, over 70% of Americans surveyed said they are currently living paycheck-to-paycheck and 4 out of 10 families would struggle to write a check for $400 today.

The answer to solving this problem isn’t anything magical. In fact, it starts with learning how to start a budget. It’s really that simple.

There is an old saying that goes, “What gets measured, gets managed”.

If you can measure the money coming in and going out of your life, you can manage it.

How to Start a Budget

Before we start, let’s all agree that you don’t like the word budget. In fact, if you’re like the majority of people; budget is also a cuss word.

Therefore, we are going to stop calling it a budget starting right now. Instead, we will replace it with a name that is much more fun than a budget.

Budget

The Cash Flow Formula.

Now that’s out of the way, let’s get started.

Step 1: Figure Out Your Monthly Income

What is you monthly income or average monthly income if you get paid in waves. This may be extremely easy for you.

However, some of you get paid in all different ways, and trying to figure out what you get paid each month may take some effort figuring out.

If you get paid bi-weekly, then you will also want to learn about that magical 3rd paycheck that comes twice a year.

Step 2: Determine What Your Money has Been Doing (or Not Doing)

Many of you probably have been feeling it, but now you are actually going to see it on paper. Look back at the last 90 days of bank statements. You are going to go through each expense and drop them into the following categories:

- Mortgage/Rent

- Utilities

- Groceries

- Television/Internet

- Cell Phone

- Insurance

- Fuel

- Dining Out & Entertainment

- Clothing

- Personal Care/Health

- Other stuff (but give it a name)

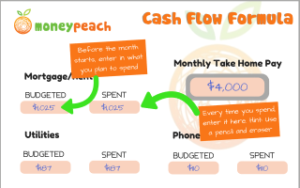

Next, print off the Cash Flow Formula. Once you access the Cash Flow Formula, you will also see a template to show you the steps and a blank one for you to use. Print them off and use them for the next steps.

Step 3: Create Your First Cash Flow Formula

Enter your income in the top right of the first page in the Income box. This is your starting point. This is how much you have to spend, this is how much you are going to spend, and you cannot go over that number. Think of it as gas in your car and you are planning a road trip. You wouldn’t dare drive across the country without a fuel gauge, right?

Then why would you want to go through life just guessing with the money?

Bonus: Cash Flow Formula App

This is my all time favorite budget tool and the same exact one our family has used since 2011. It’s clean, simple, easy, and it’s free. If you have ever used a spreadsheet before, then this is going to be extremely painless and easy for you. If you haven’t and still want to try it out, I will even send you a video on “How to set it up” and “How to get it on your Phone” so you can enter stuff in your budget like an app! Most people download and use this budget, but the Paper and Pencil Budget is available for you also. Either way, I have you covered!

Step 4: Within Each Category, Determine What You Can Spend

The first page will be easier because you already know what your mortgage/rent is, you have an accurate estimate what your utilities will be, and you can easily look up to see what you are paying for cable, internet, phone, etc. At the bottom-right of each page, add up the total for what you have spent and put it there. Repeat this process for each page.

Step 5: Rinse and Repeat

More than likely you may be spending more than you have.

This is 100% normal and is also the whole entire reason why you are starting a cash flow formula – to regain control of your money. Now is where you are going to go back and trim the fat from cash flow plan.

This part is going to be painful at first because we are finally telling ourselves “No” to something. “No” is a powerful word. It is a sign of maturity. It is a sign that you are on your way to winning with money. It will set you free.

How about No…

- I am not going to live paycheck-to-paycheck the rest of my life

- We don’t want to be broke in our later years

- The normal savings rate in America isn’t for us

- I would rather know more about my finances than who won the Bachelorette Season 7

Once your expenses are all added up and equal to your income, you are done creating the cash flow plan.

However, now you need to stick to YOUR plan. You created it, you built it, and you decided where your money is going next month. This is going to be a behavior change over the next month. Every time you make a payment or spend money in a category, enter it into Spent using a PENCIL because you are going to need that eraser each time money leaves your account. For example, when you get gas in your car, you will need to add it in to the Spent column.

It is easy to wander around life aimlessly and end up nowhere. It is hard to be deliberate with your life end up somewhere awesome. You choose.

Cash Flow Formula Hacks

- Always get a receipt and take it home with you – this will help you remember what you spent and for which category it is coming from

- You are not going to be perfect the first month. It will get a little better the second month and you are going to be okay the third month. It usually takes 60-90 days to really become awesome with your cash flow plan. That is normal so don’t be discouraged. You weren’t very good at driving your car when you first sat behind the wheel either

- You are going to have 37 emergency cash flow formula meetings the first month. This is normal – it is difficult to plan for everything in the beginning, so don’t freak out

- Leave a buffer in your checking account! We are going to spend all of our money on paper before the month starts, but you’ll need to leave a buffer in your account so you don’t overdraft. A trick here is to put a date next to each category for when the money will leave your account. There is always going to be a week in your cash flow plan where most of you money comes out. Be prepared for it

- Don’t over complicate things. We are using 5th grade math.

- Try using cash for 3 categories: I recommend – Groceries, Entertainment/Dining Out, & Clothing/Shopping

Summary

You are now on your way to starting your very own budget…ahem – the Cash Flow Formula. Congratulations!

The day we started our cash flow formula is the same day we decided to change our family tree. The same day we decided to get out of debt. The same day we became determined to build wealth.

What would it feel like to not have any debt, to have money in savings, and have the ability to truly build wealth? What would you be doing with your life if this was your reality?

You get to decide – it’s right in front of you if you will just start. Start by doing the cash flow formula each month. This one simple choice you make in your life will change your financial future forever. Do it!

You May Also Like