In 2006, then Harvard Law Professor Elizabeth Warren co-authored a book with her daughter: All Your Worth: The Ultimate Lifetime Money Plan.

The book introduced a very simple method for budgeting: The 50-30-20 budget.

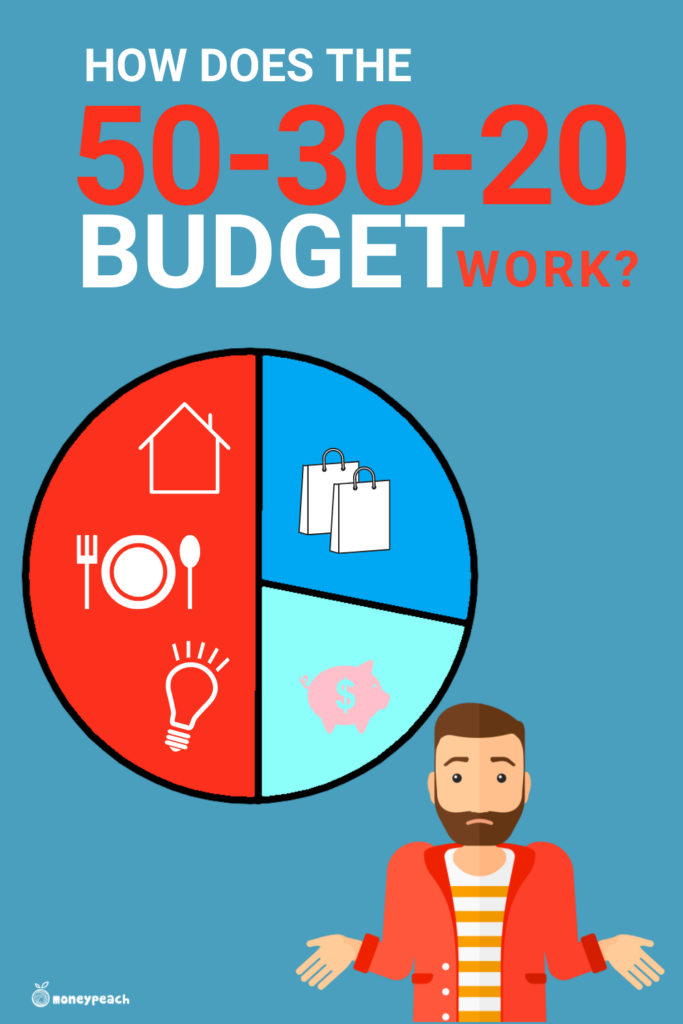

The budget is broken down into percentages of your after-tax dollars and creates a system to show how much you should be spending in each category.

The first 50% goes to your basic needs, the next 30% to your basic wants, and the last 20% to your savings and/or debt payoff.

The first step; determine your take-home pay.

Determine Your Take Home Pay

Think of your take-home pay as the money you actually have to spend each month. Another way to think about it is the money that hits your checking account.

For some of you, this will be simple. If you’re a W-2 employee, just look at how much is deposited into your checking account each month from your paycheck.

However, if you are an entrepreneur, a freelancer, an independent contractor, or someone who has fluctuating income, you’ll need to determine your take-home pay using the irregular income method.

Free Budget Templates: Grab the budgeting templates and download the how-to-budget mini course here.

The 50% Needs

Half of your take-home pay will go to the “needs” in your monthly budget. This includes things like your mortgage/rent, utilities, groceries, insurance, auto payments, and minimum payments on your credit card.

If you are having trouble deciding between “needs” versus “wants”, just ask yourself what you would need if you lost your income tomorrow.

You would need to keep a roof over your head and you would need to keep your lights on.

On the contrary, you may want to take a vacation or you may want to go to a fancy restaurant.

The 30% Wants

When you first think of “wants” you may be thinking about a nice vacation, a new car, or the latest pair of shoes.

Not so fast.

While those are definitely things you may want, the luxurious things in life don’t fall inside the 30% of the 50-30-20 budget. Instead, you can think of the everyday things you want but you may not necessarily need to make up your 30%.

This includes your unlimited data plan, your premium cable channels, and your weekly house cleaning. Anything in your life that you could live without for the short-term during a financial crisis falls into the 30% wants.

The 20% Savings and Debt Payoff

After you have gone through all of the needs and wants, there is only 20% leftover. This is going to be allocated to building an emergency fund, paying down debt, and increasing your savings. This also could be for building retirement savings if you’re using an after-tax retirement account such as a ROTH IRA.

Emergency Fund

One of the most important parts of any financial plan is your emergency fund. This is the cushion between you and disaster.

A good rule of thumb is to build an emergency fund of between three and six months worth of your needs expenses. If you are someone who has a steady and reliable source of income, you could lean towards a three month emergency fund. For those of you who are in sales, work on commission, or may have more volatility with your income — then go with a six month emergency fund.

Remember, your emergency fund is based on your needs, not on your income.

Debt Payoff

As you remember from earlier, all minimum payments are your “needs”. Your car payment and your credit card minimum payment will fall into the 50% needs category.

Anything you pay above that will fall into this 20%. A great way to pay down debt using this budget method is to use the debt snowball.

Savings

By savings, we are talking about saving for those bigger wants in life. Maybe it’s for a vacation, a down payment for a house, or a new car. You could set aside cash each week or you could create sinking funds (individual savings accounts) to help organize your savings.

Wealth Building

The majority of people save into pre-tax retirement savings such as a 401(k), a 403(b), TSP, or an IRA. Since we utilize after-tax income for this budget method, we would not include retirement savings inside the 20% savings and debt payoff.

However, some of you may want to utilize a ROTH IRA which allows you to invest with after-tax dollars instead of pre-tax dollars like the 401(k).

Any post-tax retirement savings or other wealth building strategies would fall into this 20% category.

Example of 50-30-20 Budget

Now that we have broken down the 50-30-20 budget, let’s use a few real-world examples.

Mark and Cindy’s 50-30-20 Budget

Mark and Cindy both work full-time and their household income is $110,000 per year. Their take-home pay (after-tax) is $6,500 per month.

50% Needs = $3,250

This means their “needs” should be less than or equal to $3,250. If Mark and Cindy have a $2,500 mortgage, then that leaves only $750 for utilities, insurance, car payments, groceries, and all other basic needs.

A good rule of thumb is to keep your mortgage payment at 60% or less of your total needs. In Mark and Cindy’s example, a mortgage payment of $1,950 or less would give them enough money for the other needs in their budget.

30% Wants = $1,950

Mark and Cindy have $1,950 to spend on the wants. Remember, these are not the luxuries in life, but simply the everyday things inside their monthly budget that really doesn’t qualify as a need.

This could be going out to dinner with friends, cable, house cleaning, landscaping, and random purchases they make throughout the month.

20% Savings & Debt Payoff = $1,300

The remaining 20% will be applied to Mark and Cindy’s savings and debt payoff.

Depending on where they are at in their financial journey, maybe Mark and Cindy take the 20% and build up an emergency fund. Once the emergency fund is built, maybe they apply half of the 20% towards their debt and the other half to savings — including after-tax retirement savings if they choose to do so.

Free Budget Templates: You can also use these budget templates with the 50-30-20 budget!

Mandy’s 50-30-20 Budget

Mandy is single and just graduated college. She now earns $65,000 per year and her take-home pay (after-tax) is $3,800 per month.

50% Needs = $1,900

Mandy has $1,900 per month to spend on her needs. The biggest need she most-likely will have is her rent or mortgage. If she chooses to use the recommended 60% of her needs for her rent or mortgage, this gives her a budget of $1,140 each month.

After she pays the rent/mortgage, Mandy will have $760 leftover to pay for utilities, groceries, gas, car payment, student loan payment and any other needs she has inside her monthly budget.

30% Wants = $1,140

Mandy has just over a thousand dollars per month to spend on things like going out to eat, her cell phone, clothes shopping, and getting her car washed.

Any other extravagant or luxurious things she wants in life won’t be included in this 30% and will be saved for the last 20%.

20% Savings/Debt Payoff = $760

Now that Mandy has taken care of her basic needs and wants, she has $760 leftover for savings and debt payoff.

Maybe Mandy decides to build up her emergency fund to $5,000 and applies all $760 every month until it’s complete. This means six months from now Mandy could start throwing some (or all) at her debt and save the rest for the trip to Europe she has been dreaming about.

Advantages of the 50-30-20 Budget

The main advantage of the 50/30/20 budget is that it’s extremely simple. If you know you’re take-home pay each month, then you can create each percentage and you are ready to go.

And, if you are someone who has never attempted to do a monthly budget, starting with the 50/30/20 budget is a great starting point for managing the everyday money.

Disadvantages of the 50-30-20 Budget

This method of budgeting is extremely simple and straightforward, but it definitely has its drawbacks.

Doesn’t work well with high-income earners

If you are a high-income earner, it wouldn’t be wise to follow the 50-30-20 budget. For example, let’s say your income is $700,000 per year and your take-home pay is $33,000 per month.

Using the 50-30-20 rule, your basic needs would be $16,500, your basic wants would be just under $10,000 per month and your savings would only be $6,600 per month.

As you can see, this method doesn’t paint a very good picture for high-income earners who have the ability to save at a much higher percentage.

Doesn’t work well with low-income earners

If you’re a lower income earner, it also would not be a good idea to use the 50-30-20 budget. The reason is 50% may still not be enough to take care of the basic needs in your life.

For example, let’s assume your income is $24,000 per year and your take-home pay is $1,500 per month. If you use the 50% rule for basic needs, this only leaves you $750 for rent/mortgage, utilities, groceries, and all other basic necessities. Most-likely, 50% wouldn’t be enough in this scenario.

Doesn’t account for after-tax investing

Where does the 401(k) and the ROTH IRA come into play?

When using the 50-30-20 rule, 20% of your after-tax income is set for savings. But what if you are already investing in your 401(k) with pre-tax dollars?

Slows down debt payoff

The quickest way to building long-term wealth is to free up any money going towards debt and start saving.

In the example used above, you see that someone like Mandy may be stuck paying debt off for years and years if she’s only throwing 20% at her student loan. If you really want to get out of debt, 20% rarely gets you there soon enough.

The 50/30/20 Takeaway

The 50-30-20 budget is extremely simple and quick to implement. However, there are some major drawbacks to the simplicity.

Personally, I am not a huge fan of the 50-30-20 budget because there are other simple budgeting alternatives that just work much better. If you’re looking for a simple budget that can be used with all incomes, take a look at these 7 steps to creating a very simple budget.

Start a Very Simple Budget

The 50-30-20 budget is good, but there are much better budget methods out there. I will walk you step-by-step to show you how to create a simple budget and also give you templates to get started.

Good luck with your new budget!